Jan 14, 2021

Oil pauses near US$53 with rising fuel supplies threatening rally

, Bloomberg News

Oil in New York was steady after a rally that pushed prices to the highest level in 10 months ran out of steam as a rise in U.S. fuel stockpiles added to concern over a shaky demand outlook.

Futures traded near US$53 a barrel after snapping a six-day advance in Wednesday’s session. Stockpiles of gasoline and distillates -- a category that includes diesel -- both increased by more than 4 million barrels last week, according to government data. Crude inventories declined for a fifth week.

Plunging temperatures, meanwhile, have led to rising energy consumption to meet heating needs and Goldman Sachs Group Inc. is forecasting the cold snap may boost demand by at least 1 million barrels a day. Asian utilities are snapping up prompt supplies of fuel oil as power use surges.

Oil is up almost 50 per cent since the end of October following COVID-19 vaccine breakthroughs and Saudi Arabia’s pledge for deeper output cuts. A resurgent virus in some regions, however, is expected to crimp demand and potentially weigh on further price gains. Japan has expanded its state of emergency, while the U.K. reported the most deaths since the pandemic began.

“We need to see some reduction in the product side of the equation before we make the next leap higher,” said Stephen Innes, chief market strategist at Axi. “I don’t think we are going to go much lower. This rally now goes from an OPEC driven rally to a vaccine distribution rally.”

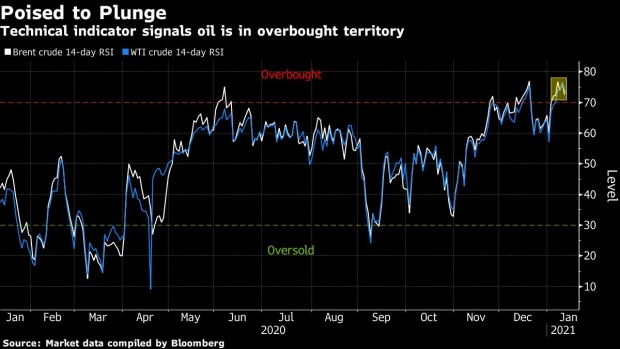

A stronger dollar helped to halt oil’s momentum on Wednesday, making raw materials such as crude that are priced in the currency less attractive to investors. A technical indicator is also signaling WTI is overbought.

China’s economic recovery gathered pace in December as the nation’s exports expanded strongly, pushing the trade surplus to a record high. Oil imports, however, fell about 15 per cent last month from November.

The Energy Information Administration reported on Wednesday that U.S. gasoline stockpiles rose by about 4.4 million barrels last week and distillate inventories gained by 4.79 million. Crude supplies fell by 3.25 million barrels.