Nov 19, 2021

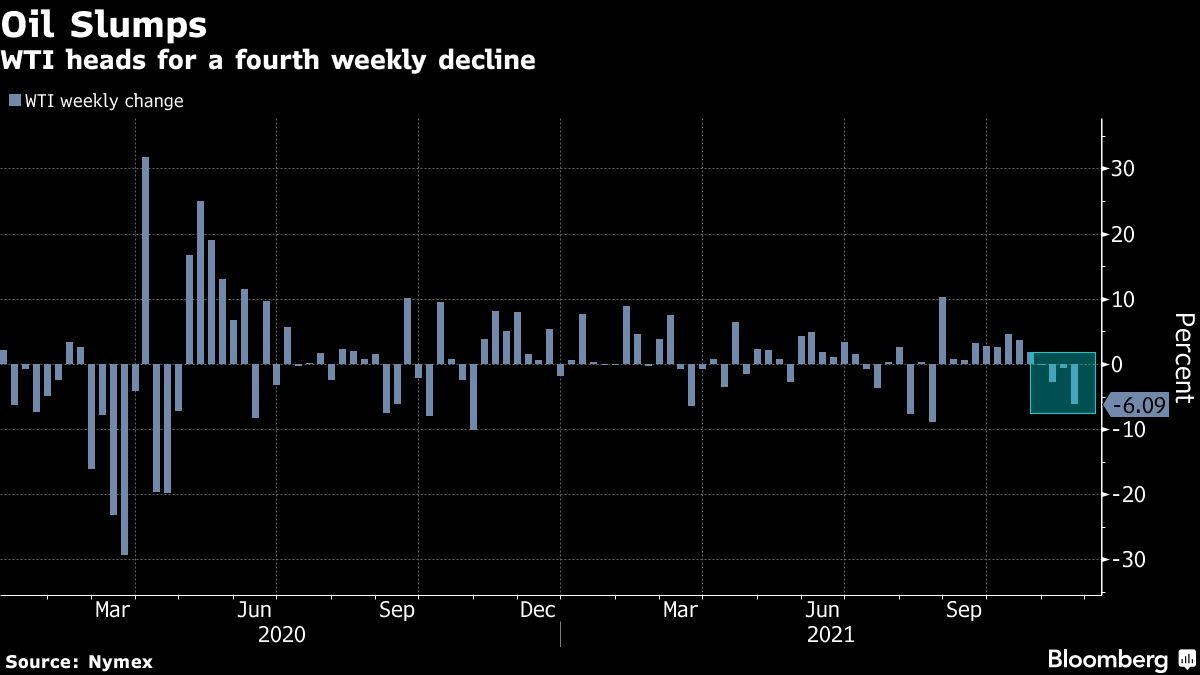

Oil posts fourth straight weekly loss as COVID wave clouds market

, Bloomberg News

Oil logged its biggest weekly drop since August as Europe’s worsening COVID-19 crisis renewed the prospect of lockdowns just as key consuming nations look to add emergency supply to the market.

West Texas Intermediate for January delivery tumbled 3.2 per cent, while the expiring December contract lost 3.7 per cent. Europe’s Brent skidded 2.9 per cent. The wave of infections in Europe is growing, once again raising the prospect of mobility restrictions that would hit oil demand. Austria imposed a lockdown while Germany introduced some restrictions.

The concerns come as the oil market fixates on the prospect of releases from strategic crude reserves by the U.S. and China. The latter said Thursday it was working on one, while the U.S. has repeatedly said the option to tap its Strategic Petroleum Reserves remains on the table.

“It’s a potent one-two punch for the petroleum complex, when there is a looming supply burst combined with a hit to demand from the virus,” said John Kilduff, founding partner at Again Capital LLC.

After rising to the highest in seven years, oil has faltered over the past month even as the Organization of Petroleum Exporting Countries and its allies stuck with a cautious approach to restoring output. Alarmed by surging gasoline costs, U.S. President Joe Biden tried and failed to get the OPEC+ group to deliver more crude and then pivoted to a possible release from America’s Strategic Petroleum Reserve. Potential weakness in China’s economy has also contributed to the bearish factors.

Despite the renewed demand fears, Friday’s sell off may have been overdone, according to Goldman analysts including Damien Courvalin and Callum Bruce. High-frequency inventory data points to a supply-demand imbalance of around 2 million barrels a day over the last four weeks, with OECD crude and Atlantic basin at seven-year lows.

“This magnitude of deficit is in fact on its own sufficient to absorb the current perceived headwinds to the oil bull thesis, with lower prices in fact reducing the odds of a strategic release,” they said in a note.

Meanwhile, the so-called prompt WTI spread continued to narrow as supplies grow at the Cushing, Oklahoma, hub. The January contract settled at 71 cents premium to February futures, the smallest premium since mid-October.

The rout also extended into refined product markets. Benchmark U.S. gasoline and heating oil crack spreads, a reflection of refining margins, slumped more than 5 per cent each. Europe’s diesel crack also fell sharply.

Prices:

- Brent fell US$2.35 to settle at US$78.89 a barrel in New York

- WTI for January delivery lost US$2.47 to reach US$75.94

- The December contract, which expires Friday, was down US$2.91 at US$76.10

Some traders were still placing bullish bets in the options markets, despite the selloff in prices this week. Contracts that would profit a buyer from a rally toward US$200 traded on Thursday for the second week. While relatively cheap, such bets protect against a potential spike in prices.

Other stories:

- Jitters over China’s crude demand are spreading in the physical market due to the likelihood of another tax probe into independent refiners as well as potential releases from its oil reserves, dragging down spot premiums of a Russian grade favored by those processors.

- High power and gas prices are adding US$6 a barrel to oil refining costs, according to Bank of America.

- A fleet of tankers laden with Russian diesel may help alleviate high East Coast prices.