May 26, 2023

Oil posts second weekly gain as debt-limit deal inches closer

, Bloomberg News

We haven't invested enough on the supply side to meet energy demand growth: Head of commodities

Oil rose a second consecutive week as investors monitored progress made Friday on debt-ceiling talks to avoid a U.S. default.

Republican and White House negotiators were moving closer to an agreement to raise the debt limit, according to people familiar with the matter. Still, the agreed-upon details are tentative, and a final accord isn’t in hand.

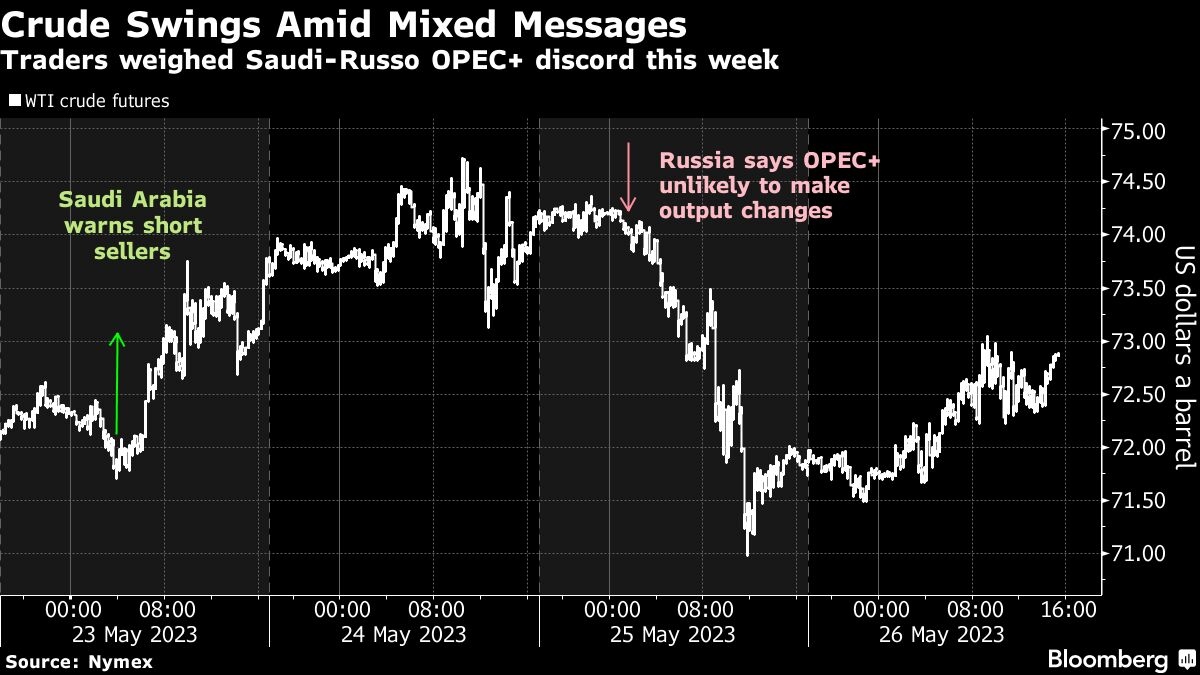

Supply dynamics remain in focus, with Saudi Arabia and Russia offering conflicting statements on the potential for more cuts from OPEC and its allies. Russian Deputy Prime Minister Alexander Novak said that OPEC+ wasn’t likely to take further measures at its gathering in Vienna in June, contrasting with Saudi Energy Minister Prince Abdulaziz bin Salman’s remarks earlier in the week that speculators should “watch out.”

Crude has still sunk almost 10 per cent this year amid the lackluster economic recovery in top importer China and the aggressive monetary tightening campaign by the U.S. Federal Reserve. More U.S. rate increases may be in store, with traders pricing in another quarter-point hike within the next two meetings.

Prices:

- WTI for July delivery rose 84 cents to settle at US$72.67 a barrel in New York.

- At that level, the contract is up about 1.6 per cent for the week.

- Brent for July settlement added 69 cents to settle at US$76.95 a barrel.