May 4, 2021

Oil rally pauses as investors weigh rising gasoline supplies

, Bloomberg News

In 2021 our focus is to generate cash to pay down debt: Suncor CEO on Q1 earnings

Oil was little changed, giving up earlier gains as traders assessed an increase in gasoline stockpiles and technical signals suggesting the commodity’s rally was due for a pullback.

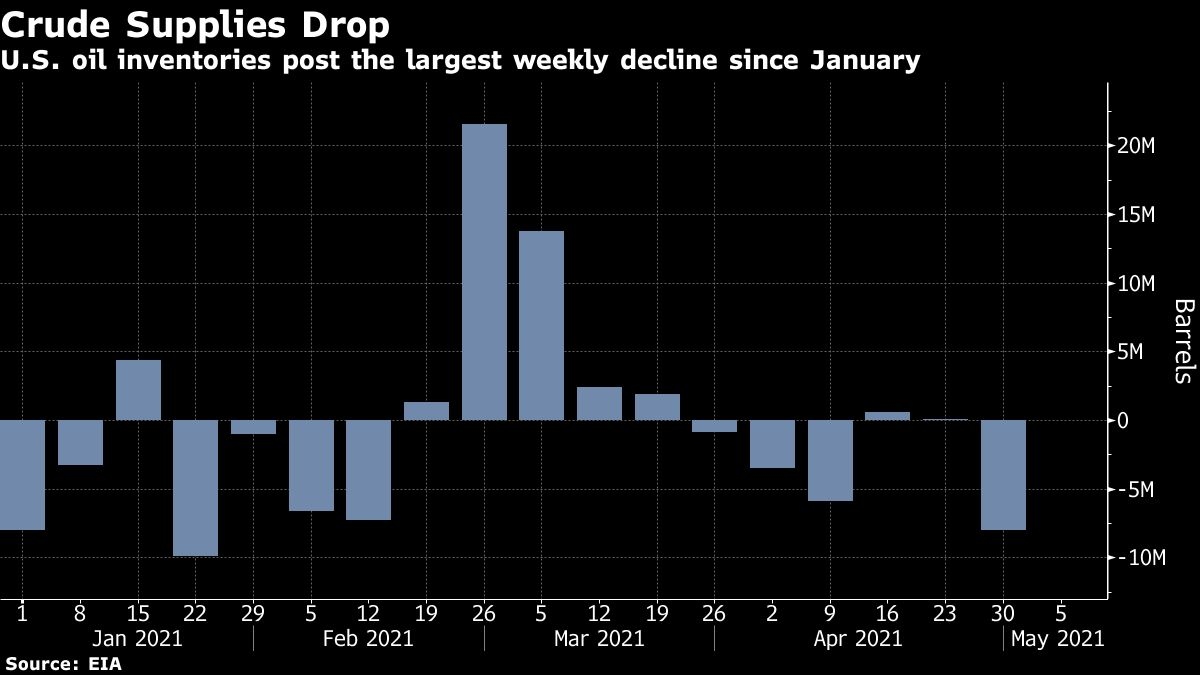

Futures in London pared a gain of as much as 1.6 per cent after testing a run to the key psychological US$70-a-barrel mark. While an Energy Information Administration report on Wednesday showed U.S. crude stockpiles fell by nearly 8 million barrels last week and exports surged by the most on record, gasoline inventories rose for a fifth straight week.

Crude has advanced alongside a broader rally across raw materials that’s driven the Bloomberg Commodity Spot Index to the highest in almost a decade. The earlier oil rally failed to break through key resistance levels, and prices flirting with the upper Bollinger band in recent sessions added to bearish pressures. The longer-term demand recovery continues to be underpinned in the U.S. by the rollout of Covid vaccines as the country reopens.

Oil “had a great run, but it got a little bit ahead of itself,” said Phil Streible, chief market strategist at Blue Line Futures LLC in Chicago. “We’ve hit resistance and prices pulled back,” but it’s hard to see a summer demand boost “being derailed,” he said.

Beyond headline prices, the closely watched spread between U.S. benchmark crude’s two nearest December contracts has widened its bullish backwardation structure this week, reflecting expectations for an improving supply and demand dynamic.

The crude draw “is indicating that not only is the U.S. economy reopening, but given the export number, international markets are opening back up as well,” said Brian Kessens, a portfolio manager at Tortoise, a firm that manages roughly US$8 billion in energy-related assets. “It seems like, at least in the developed world, we’re seeing pretty constructive reopening” progress.

While the U.S. and Europe are charting a course for reopening, the COVID-19 crisis in India may yet worsen. Saudi Arabia has lowered its prices for Asian customers as case numbers in the key crude importer crimp energy demand. Consultant Facts Global Energy now expects India’s oil-product demand to drop 670,000 barrels a day in May from March levels, larger than previously forecast.

Prices:

- West Texas Intermediate crude for June delivery lost 6 cents to settle at US$65.63 a barrel

- Brent for July settlement edged 8 cents higher to end the session at US$68.96 a barrel

Refinery utilization in the U.S. climbed back above its 5-year average more than a year after the pandemic devastated oil consumption, though that includes year-ago levels that factor in the more immediate aftermath of the coronavirus fallout. Pent-up travel demand in the country is seen spurring a 30 per cemt jump in jet fuel use this summer -- one of the worst-hit parts of the barrel as international travel remains anemic.

Investors are betting that rising vaccine-aided demand and greater mobility in key economies will drain crude stockpiles and support higher prices.

Related news:

- Some in the oil market are gearing up for US$100-a-barrel crude.

- Despite predictions of peak oil and the impending demise of fossil fuels, Asian refiners are expanding at a breakneck pace, building new plants designed to run for at least half a century.

- Energy trader Gunvor Group Ltd. racked up its best ever trading result last year, joining rivals in taking advantage of wild price swings caused by the pandemic.

--With assistance from Alex Longley and Jack Wittels.