May 18, 2023

Oil Price Cap Is Hitting Russian Revenue Hard, US Treasury Says

, Bloomberg News

(Bloomberg) -- A Group of Seven cap on the price of Russian oil is successfully choking off the nation’s access to petrodollars, the US Treasury Department said, a day after Moscow acknowledged “problems” with government revenue.

The measures, a reaction to the invasion of Ukraine, have cut the Kremlin’s oil earnings in the first quarter by more than 40% from a year ago, the Treasury said in a report Thursday, citing Russian finance ministry data.

“The price cap policy is a novel tool of economic statecraft,” the Treasury, led by Janet Yellen, said in the report. “This restriction has worked to limit Russia’s ability to profit from its war while promoting stability in global energy markets.”

Read more: How an Aging Armada and Mystery Traders Keep Russian Oil Afloat

In December, the US and its allies imposed a limit of $60 a barrel on Russian crude — designed to keep oil flowing to avoid a price spike when a European Union import ban started. Anyone buying above that level was barred from accessing key G-7 shipping services, especially tankers and insurance.

The report from the Treasury department comes as G-7 leaders begin gathering in Japan, where concerns around Russia, as well as China, are expected to dominate discussions.

Read more: G-7 Latest - Biden Portrays Unity With Allies on Russia, China

Some analysts and traders have suggested Europe’s ban on Russian oil imports have done more to depress the price of the nation’s crude. Meanwhile, the cap meant traders could still hire and insure the tankers they needed to maintain exports, which have stayed very high.

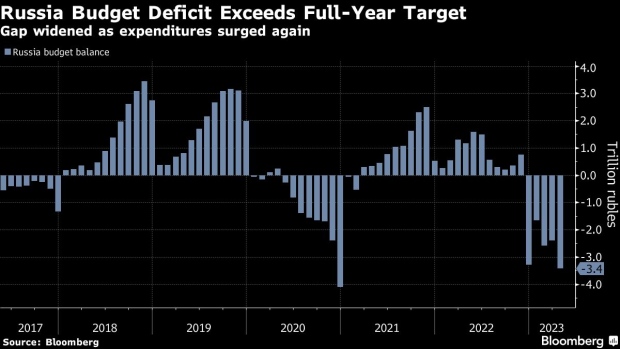

Russia’s budget deficit surged in the first four months of the year, exceeding the full 2023 target as spending surged while oil and gas revenues plunged.

Oil revenues shrank by two-thirds from last year’s level in April, hit by Western sanctions and a currency impact, according to data earlier this month from the finance ministry.

The Treasury has said previously that the cap is working, but the Russian government’s acknowledgment of the challenges adds weight to the analysis.

Russian Finance Minister Anton Siluanov said Wednesday that the country’s oil and gas revenue is falling behind target so far this year, citing discounts on Russian export crude and the general market situation.

“There are problems with oil and gas revenues,” he said, without citing the war or sanctions.

The price of Urals, the nation’s key export blend, has been trading at a discount to global benchmark Brent, which has averaged about $76 this month compared with $112 in May 2022.

The Treasury report also noted that oil revenues this year account for 23% of Russia’s budget, compared with up to 35% before the war.

©2023 Bloomberg L.P.