Mar 23, 2022

Oil rallies as U.S. stockpiles shrink, Black Sea terminal shuts

, Bloomberg News

Higher global energy prices makes a perfect storm for the TSX: Strategist

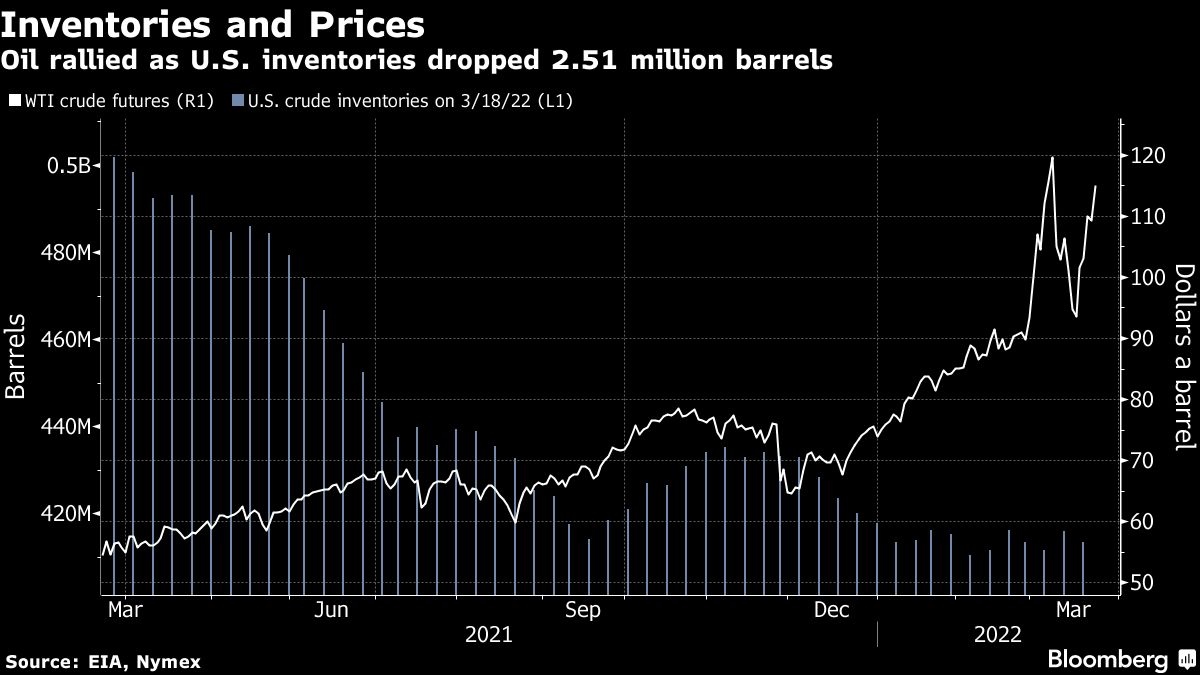

Oil pushed higher after a government report showed U.S. crude inventories dropped, while storm damage to a vital Black Sea export terminal worsened supply risks.

West Texas Intermediate rose more than US$5 a barrel to settle close to US$115 on Wednesday. Markets rallied on news that a major Black Sea oil export terminal halted loadings and faces weeks of disruption. Exports could be curtailed by 1 million barrels a day, further depriving the European market. Further bullish signals came as U.S. crude stockpiles fell 2.51 million barrels last week, according to an Energy Information Administration report.

Meanwhile, European Union and NATO leaders are set to gather in Brussels on Thursday to beef up their response to Russia’s invasion of Ukraine. Ahead of the meetings, White House National Security Adviser Jake Sullivan said that the U.S. and its allies will impose further sanctions on Moscow.

“The energy market is looking at the short-term situation and medium-term situation and it’s bleak,” said Ed Moya, senior market analyst at Oanda. “You’re looking at an elevated chance here of big swings higher and that the recent highs of US$130 for WTI probably will prove not to be too hard to break.”

With the conflict dragging on, the EU is weighing a possible ban on Russian crude imports, though some member states including Germany have opposed such a move. Many buyers however are already shunning the nation’s oil, with TotalEnergies SE saying it will stop purchases by the end of the year, while Japanese refiner Eneos Holdings Inc. will halt new shipments.

The Caspian Pipeline Consortium sea terminal said on its website that two out of three moorings sustained significant damage in recent bad weather. Russia, which sends some crude through the terminal, said Tuesday that exports could be curtailed by 1 million barrels a day, but the disruption could be bigger if all shipments through the terminal are stopped. Russian Deputy Prime Minister Alexander Novak said the repairs could take up to two months.

Prices:

- WTI for May delivery rose US$5.66 to settle at US$114.93 a barrel in New York

- Brent for the May settlement increased US$6.12 to settle at US$121.60 a barrel

With many buyers avoiding Russian crude, the country’s flagship Urals grade has plunged, while some April-loading shipments were canceled. That’s adding to the signs of increased pressure on the nation’s oil market.

Nevertheless, some Russian flows are still finding takers. India’s refiners have grabbed multiple cargoes of Urals crude this month, while China’s private processors are thought to be targeting favored grades from the east of Russia.

Related news and commentary:

- European energy prices surged after President Vladimir Putinsaid Russia will demand payments in rubles from natural gas buyers it deems “unfriendly.”

- Brent oil will likely hit US$150 a barrel this year as the supply shock from the war in Europe coincides with resilient demand from people keen to travel after the virus, according to veteran commodities trader Doug King.

- Swiss trader Mercuria Energy Group Ltd. secured a US$2 billion emergency credit facility from banks as commodities prices surge following Russia’s invasion of Ukraine.