May 26, 2020

Oil Rally Pauses on Report Russia May Ease Supply Cuts in July

, Bloomberg News

(Bloomberg) -- Oil declined following a report that Russia was planning to start scaling back output curbs from July, and as tensions between the U.S. and China continue to simmer.

Futures in New York slipped 0.6%, after rising 3.3% on Tuesday. Moscow is determined to start easing production cuts from July, sticking to the terms of the OPEC+ deal struck earlier this year, according to people familiar with the key producer’s position. Earlier, Vladimir Putin‘s spokesman said Russia and its OPEC allies would analyze the global oil market before deciding on any potential changes in their output-cuts pact.

The U.S. is considering a range of sanctions to punish China for its crackdown on Hong Kong, according to people familiar with the matter, adding to the market’s more cautious tone.

Oil had forged higher Tuesday as U.S. traders returned from a holiday. Nigeria and Algeria, both OPEC members, have lifted the official selling prices for their supply, a sign that they believe customers are willing to pay more for their barrels. That would offer some respite after demand was crushed by the fallout from the coronavirus outbreak.

Output cuts have started to chip away at a massive oversupply. U.S. oil output will reach a low point of about 10.7 million barrels a day in June, which would be the lowest in two years, according to Rystad Energy.

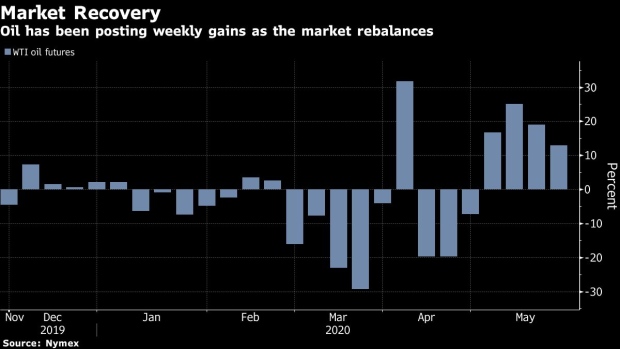

Meanwhile, demand is showing tentative signs of picking up as some economies ease lockdowns that were aimed at containing the virus. That’s helped oil surge about 80% this month, after prices tumbled below zero in April for the first time ever. The so-called futures curve is flattening -- a signal supplies are growing tighter.

Still, the fragile nature of the recovery was on display over the Memorial Day weekend in the U.S., when gasoline demand dropped an estimated 25% to 35% from a year earlier. It slid 1.34% from Thursday to Monday of the holiday weekend compared to the week prior, according to Patrick DeHaan, an analyst at GasBuddy.

©2020 Bloomberg L.P.