Mar 29, 2021

Oil rises for second day with focus moving toward OPEC+ meeting

, Bloomberg News

Stuck ship blocking Suez Canal is set free

Oil climbed to the highest in almost two weeks as traders looked ahead to this week’s OPEC+ meeting with speculation that renewed demand concerns will spur the group to keep production in check.

Futures rose nearly 1 per cent in New York, notching a second straight daily gain. Worries over the near-term recovery in demand, amid reimposed lockdown measures in Europe particularly, have raised expectations for OPEC+ to decide to keep production restrained at Thursday’s meeting. At the same time, the U.S. is providing a bright spot in the consumption rebound, with long-ailing jet fuel flashing signs of strength.

“Oil has done a really good job of shrugging off last week’s selloff, and hopefully can have a run back up to recent contract highs,” said Phil Streible, chief market strategist at Blue Line Futures LLC in Chicago. The expectations are for OPEC+ to maintain cuts “because they can see how fragile the market is, and they don’t want to derail the current recovery in prices.”

Oil is set to close out a fourth consecutive quarterly gain this week, aided by sustained supply curbs by the Organization of Petroleum Exporting Countries and its allies, and optimism that global demand will expand with COVID-19 vaccines. But a run of three weekly losses for WTI has put a dent in the rally.

“There will likely be a reprise of the last meeting, and the Saudis will likely be tough again, highlighting the recent price action,” said John Kilduff, a partner at Again Capital LLC. “The potential for a demand hit remains.”

Traders were also tracking the introduction on Monday of a new futures contract, with Abu Dhabi kicking off its bid to establish a new benchmark. The product “provides an additional tool that the market has been looking for,” Khaled Salmeen, executive director of supply and trading at Abu Dhabi National Oil Co., said in an interview with Bloomberg Television.

Prices:

- WTI for May delivery rose 59 cents to settle at US$61.56 a barrel

- Brent for the same month gained 41 cents to end the session at US$64.98 a barrel

- Both benchmarks were at the highest since March 17

- Murban for June delivery traded at US$63.40 a barrel on ICE Futures Abu Dhabi

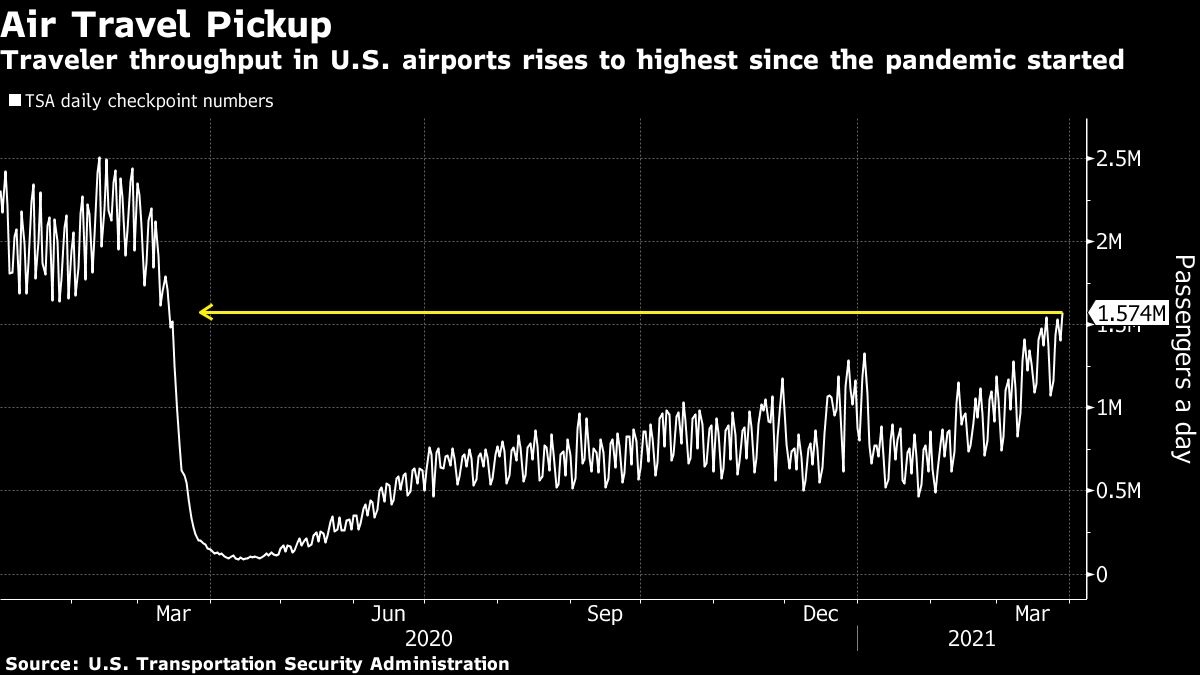

Jet fuel at New York Harbor was trading near the strongest level in weeks, giving hope to refiners who had been coping with swelling jet-fuel stockpiles as demand for the fuel lagged starkly behind that of gasoline and diesel. Foot traffic in U.S. airports rose to nearly 1.6 million on Sunday at the highest since the pandemic started, and the rebound for jet fuel may accelerate now as American Airlines Group Inc. pledges to mobilize most of its fleet in the wake of surging travel demand at home and overseas.

Pointing to the market’s underlying firmness, the spread between WTI’s two closest December contracts recovered above US$4 a barrel in backwardation -- a structure indicating expectations for improving supply and demand. Brent’s nearest timespread continued trading in a slight backwardation following a brief venture into a bearish contango structure last week.

Meanwhile, ships were starting to move in the Suez Canal after the giant container ship that’s blocked one of the world’s most important waterways for almost a week was pulled free from the bank. Hundreds of vessels were waiting to transit through the canal, shipping agent GAC said earlier, citing the canal authority.

Related News:

- Indonesian firecrews worked to extinguish a massive blaze at state-owned PT Pertamina’s Balongan oil refinery, with the company aiming to resume processing soon.

- Pipeline giant Kinder Morgan Inc. plans to expand its carbon-capture business, joining the ranks of major oil and gas companies capitalizing on clean energy investing.