Aug 29, 2022

Oil rises to highest in a month amidst global energy crunch

, Bloomberg News

Russia's reputation as a trustable commodity source is completely gone: Global energy strategist

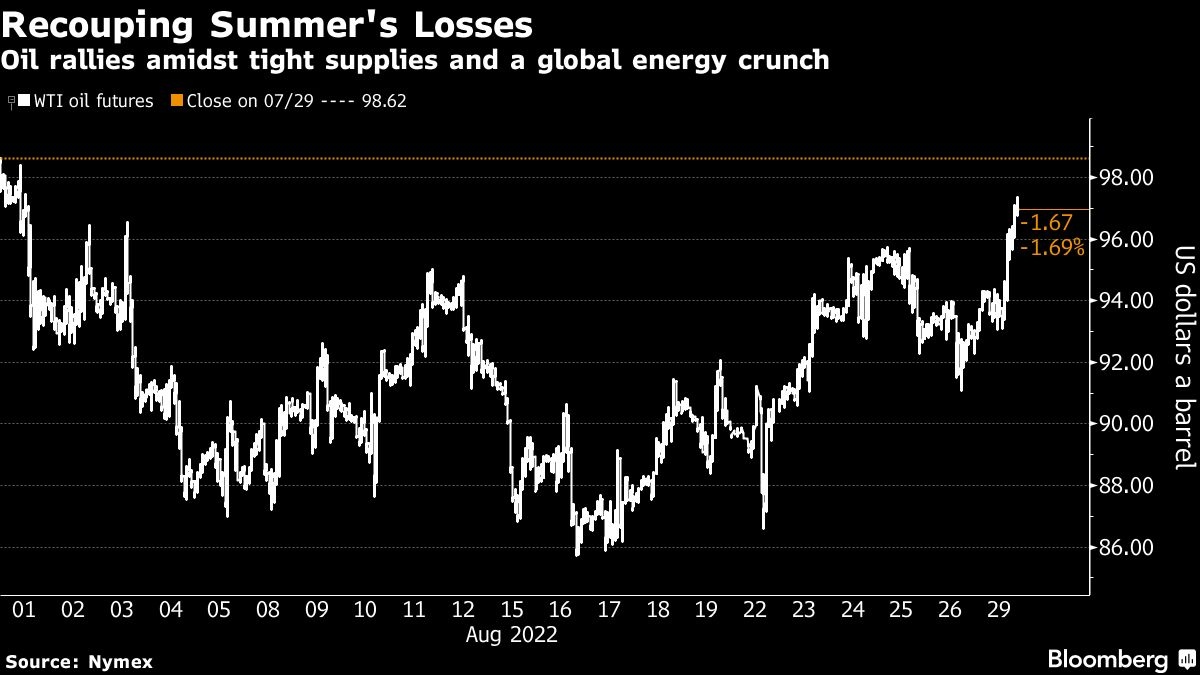

Oil climbed to the highest since late July as fears of production outages in Libya that would exacerbate a global energy crunch.

West Texas Intermediate futures rose 4.2 per cent to settle above US$97 a barrel on Monday. Although Libyan output has so far withstood clashes between militias in the capital, traders are watching for signs that the violence may halt oil shipments at a time when Europe’s energy crisis is worsening.

Iran, meanwhile, said negotiations with the US over a European Union proposal to revive a nuclear deal will drag on into September, undercutting speculation that increased oil flows are imminent.

“The one trade that everyone can agree upon is that the oil market will likely remain tight,” said Ed Moya, senior market analyst at Oanda.

Crude is on course for a third straight monthly drop on concern global growth will slow as central banks tighten policy aggressively, hurting consumption. To counter that weakness, Saudi Arabia raised the possibility last week that the Organization of Petroleum Exporting Countries and its allies could cut output. The group will meet Sept. 5 to consider October production and review the outlook for the rest of the year.

Separately, loadings from an export terminal for Kazakhstan crude have seen interruptions.

Cries of supply shortages continue to come from all corners, with Shell Plc’s Chief Executive Officer Ben Van Beurden telling a conference in Norway that it’s a “fantasy” that the global energy crunch will be easy to rectify. Speaking at the same event, Tesla Inc. CEO Elon Musk said the world needs more oil and gas now while also pushing to transition to renewable supplies.

Prices:

- WTI for October delivery rose US$3.95 to settle at US$97.01

- Brent for October settlement climbed US$4.10 to settle at US$105.09

Meanwhile, the EU is planning an emergency intervention to dampen the spike in power prices. As natural gas prices rally and trade five times higher than crude futures, it will be giving strong incentives for energy switching, said Francisco Blanch, head of global commodities and derivatives research at Bank of America Corp. in a note to clients.

In a bullish note on commodities, Goldman Sachs Group Inc. said that crude oil had scope to push higher, especially amid shortages of other energy raw materials including natural gas.