Jun 6, 2023

Oil's Saudi-driven rally erased by persistent demand fears

, Bloomberg News

The oil market is oversold: Analyst

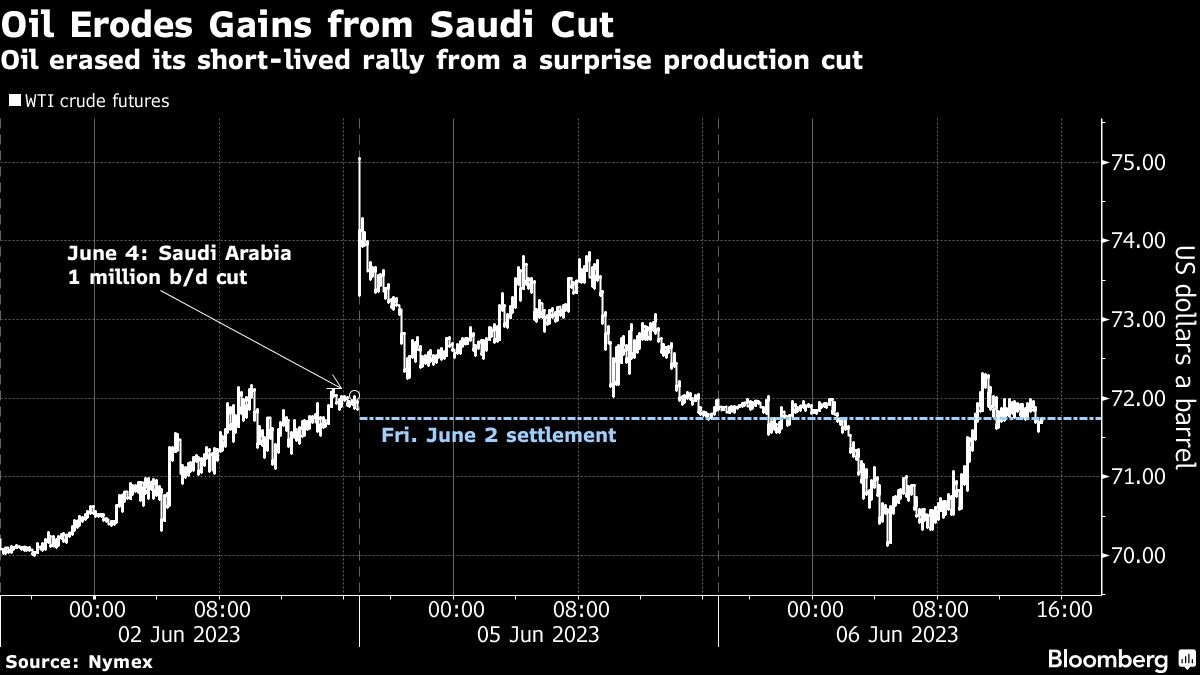

Oil fell as persistent economic uncertainty weighs on the outlook for demand, erasing a short-lived surge that followed Saudi Arabia’s surprise pledge to cut more production.

West Texas Intermediate settled Tuesday at the same closing price on Friday, effectively reversing the gain engineered by the Saudis with their weekend announcement. Brent also fell, settling just a few cents above Friday.

Saudi Arabia’s production cuts “will take some supply off the market, but demand will need to continue to rise if we are to see much higher prices,” said Dennis Kissler, senior vice president of trading at BOK Financial Securities.

Further along the futures curve, WTI for December 2023 and 2024 contracts fell from Friday’s close, evidence that traders aren’t concerned about supplies in the longterm. The U.S. sees domestic oil demand this year growing at half the rate of 2022, according to the Energy Information Administration’s monthly Short-Term Energy Outlook. The drop largely comes due to a projected slump in diesel demand.

The Kingdom’s most recent cut comes at the cost of ceding ground to two key allies: Russia, which made no commitment to cut output deeper, and the United Arab Emirates, which secured a higher production quota for 2024.

Saudi Arabia followed its move with an increase to its crude prices for the same month. That’s pushing some Asian refiners to consider buying more crude from other suppliers, including Russia.

Prices:

- WTI for July delivery slipped 41 cents to settle at US$71.74 a barrel in New York.

- Brent for August settlement declined 42 cents to US$76.29 a barrel.