Jan 21, 2022

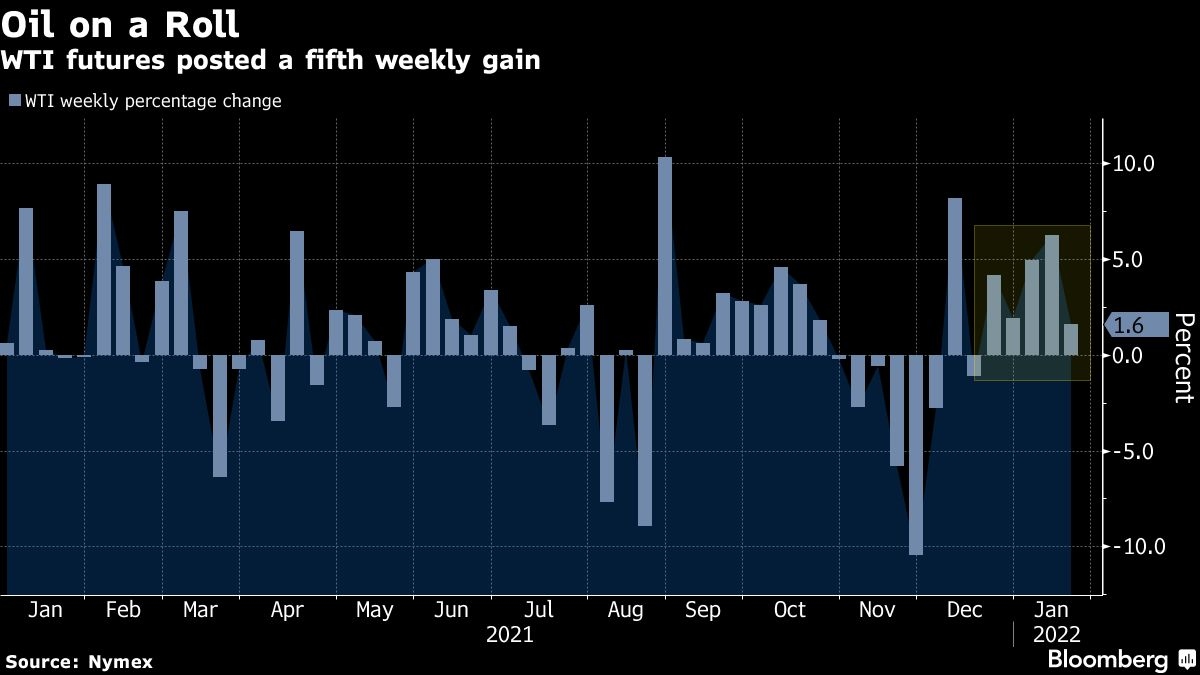

Oil caps fifth weekly gain after touching its highest since 2014

, Bloomberg News

Supply won’t rebound as fast as demand: Mike Rothman on oil markets

Oil capped its fifth week of gains on continued signs of robust demand and strained crude supplies that have taken prices to seven-year highs.

Futures in New York edged lower on Friday, just above $85 a barrel, but were still up 1.6% for the week. Oil neared $88 earlier this week for its highest level since 2014 as geopolitical tensions threatened greater supply outages alongside strong demand numbers, despite the omicron variant.

As prices rise, much of Wall Street has been growing steadily more bullish. Morgan Stanley has joined Goldman Sachs Group Inc. in forecasting $100 oil later this year, and Bank of America reiterated that it expects oil to hit $120 a barrel by the summer. Citigroup Inc. cautioned that sticking to a bullish view could be dangerous after this quarter.

Markets also dissected the strong picture of demand that multiple reports provided this week. The International Energy Agency said the oil market was looking tighter than previously thought, with demand proving resilient despite the rapid spread of omicron. Additionally, U.S. demand is still running hot, with the total volume of oil products supplied to the market at the highest for this time of year in at least 30 years, according to the U.S. Energy Information Administration.

Earlier on Friday, futures fell over 3% alongside broader equity markets and raw materials including copper.

While commodities have been extremely resilient at the start of the year due to supply risks and geopolitical concerns, they won’t “continue to be completely insulated,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Management.

Crude’s bumper rally had pushed many of the main futures contracts into overbought territory on a technical basis. Brent, WTI and heating-oil futures all moved out of that zone amid the sharp price pullback early Friday.

Prices

- West Texas Intermediate for March fell 41 cents to settle at $85.14 a barrel in New York

- Brent for March settlement slipped 49 cents to settle at $87.89 a barrel

Oil’s rally has also caught the eye of the White House as it poses a political risk for President Joe Biden. The U.S. is considering accelerating the release of strategic reserves, but many of Biden’s options to address the rally would be limited and likely short-lived.

Still, the focus remains on how much further the Organization of Petroleum Exporting Countries and its allies can lift output. Pavel Zavalny, head of the Russian Duma Energy Committee, said restoring production won’t be easy amid technical challenges and underinvestment.

Other market news:

- Trucking goods across the U.S. is getting more costly as retail diesel prices rise to a seven-year high. Retail diesel prices rose to $3.653 per gallon Thursday, the highest since October 2014.

- A Mexican mega-refinery project is expected to cost 40% more than previously estimated and is unlikely to be completed by the government’s 2022 deadline.

- Oil traders are turning their focus to a potential trade agreement between South Korea and some major Persian Gulf producers that may reduce prices of Middle Eastern crude in the months to come.