Nov 9, 2018

Oil's Support After Excessive Drop May Lie Deeper in Bear Market

, Bloomberg News

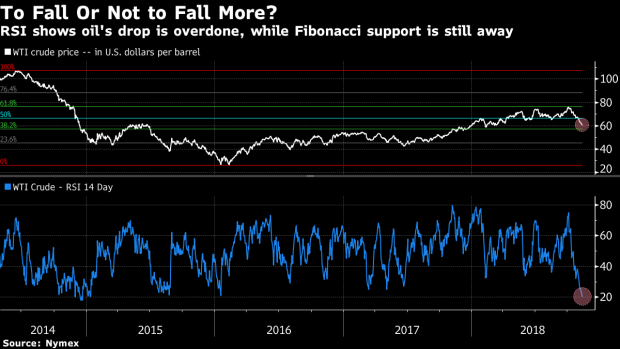

(Bloomberg) -- U.S. oil’s slump into a bear market has further stretched one technical indicator further into oversold territory, with the 14-day Relative Strength Index at a 2014 low. The gauge is near 20, well below the threshold of 30 that typically signals excessive declines.

Still, the RSI is a less reliable measure when there are relatively large price changes over a small period -- crude’s plunged over 20 percent in just a few weeks. A Fibonacci retracement analysis shows the floor for West Texas Intermediate is still over $3 lower than current levels.

Oil in New York fell for a 10th day, extending a dramatic plunge that’s dragged prices down from a 2014-high just five weeks ago. The slump has rattled producers, and the Organization of Petroleum Exporting Countries has signaled it may cut output next year -- an option that’ll be part of talks when the group meets with partners in Abu Dhabi on Sunday.

To contact the reporter on this story: Pratish Narayanan in Singapore at pnarayanan9@bloomberg.net

To contact the editors responsible for this story: Pratish Narayanan at pnarayanan9@bloomberg.net, Alexander Kwiatkowski

©2018 Bloomberg L.P.