Feb 3, 2023

Brent tumbles below US$80 as swelling supplies outweigh jobs data

, Bloomberg News

BI Strategist sees dip in gold bull vs. blip in crude oil bear

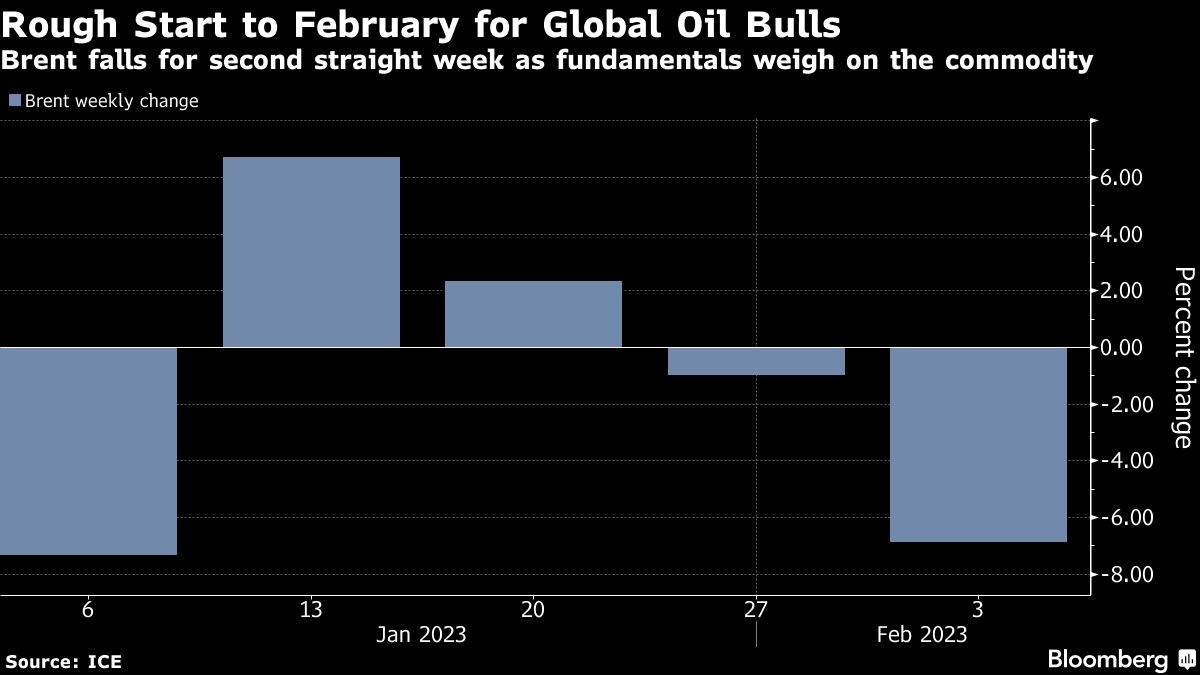

Oil tumbled to the lowest levels since early January as long-term headwinds overwhelmed the positive sentiment from a strong U.S. jobs report.

Brent crude, the global benchmark, dropped below US$80 a barrel, while West Texas Intermediate slid to less than US$74 a barrel. Futures for both grades climbed earlier in the session as record-low U.S. unemployment figures spurred optimism that demand would hold up. But those gains evaporated as concerns about swelling U.S. stockpiles and weaker-than-expected China demand dominated the trading narrative.

“The commodity fundamentals aren’t really improving or tightening up a lot,” said Bart Melek, head of commodity strategy at TD Securities. “There’s a view out there that global supplies are certainly withstanding the Russian sanctions. And of course we continue to worry about headwinds from China.”

Weekly data on market positioning published by the Commodity Futures Trading Commission will be delayed after a cyberattack on ION Trading UK meant some clearing members were unable to provide accurate data.

Prices:

- WTI for March delivery fell US$2.49 to settle at US$73.39 a barrel in New York.

- The price earlier slid to US$73.13, the lowest since Jan. 5.

- Brent for April settlement slid US$2.23 to settle at US$79.94 a barrel.

- Futures earlier dropped as low as US$79.72, the lowest since Jan. 11.