Dec 29, 2022

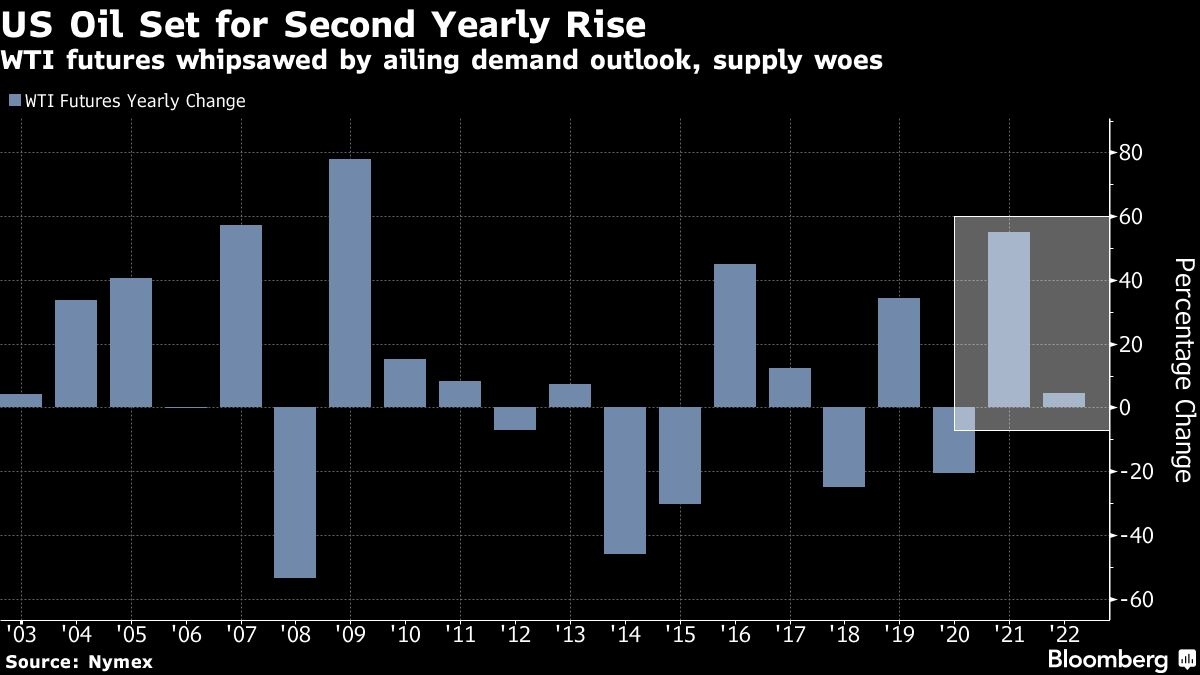

Oil set for yearly gain as investors look ahead to China rebound

, Bloomberg News

Focus on mid-cap energy stocks that generate an enormous amount of free cash flow: Energy bull

Oil is set to end a volatile year modestly higher as investors look ahead to an expected rebound in Chinese demand next year and brace for the possibility that less Russian crude will make it to buyers.

West Texas Intermediate futures traded little changed above US$78 a barrel in the final session of 2022 and are up more than four per cent for the year. China is currently tackling surging virus cases and fears are mounting about a fresh global outbreak, but there's optimism demand will eventually rebound in the world's top crude importer.

The global Brent benchmark has traded in a US$64 range this year, the largest since 2008 and at times saw the biggest weekly swings on record. At its peak shortly after Russia invaded Ukraine prices surged past US$139, but since then, gains have largely evaporated as fears of a global economic slowdown in 2023 mount.

In the U.S., TC Energy Corp. restarted the ruptured segment of its Keystone oil pipeline following a spill that forced the conduit to shut for more than three weeks. Meanwhile, US commercial crude inventories rose by 718,000 barrels last week, according to data from the Energy Information Administration.

Prices:

- WTI for February delivery little changed, up 0.4 per cent US$78.35 a barrel at 10:33 a.m. in London.

- Brent for March settlement stable at US$83.45 a barrel.

Traders are also watching for further reaction from Russia to sanctions on its energy exports following the war in Ukraine. An export ban on the OPEC+ producer's refined petroleum products will take effect early next year.