Nov 17, 2021

Oil slips to nearly six-week low as traders weigh SPR release

, Bloomberg News

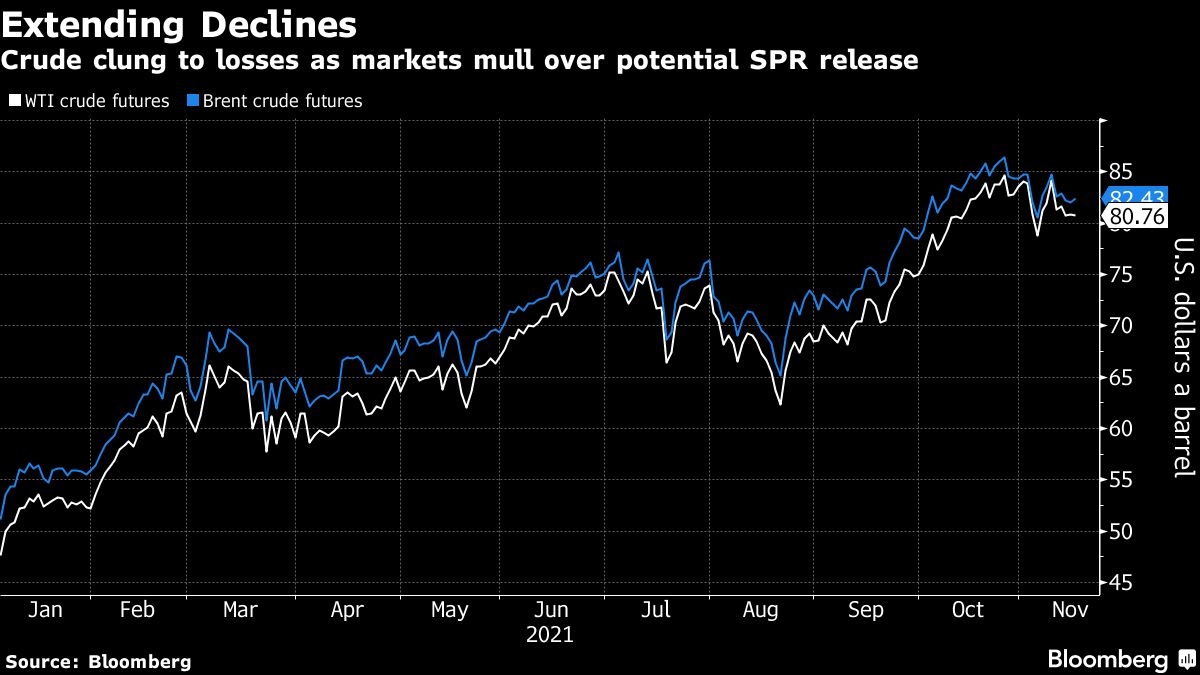

Oil tumbled to the lowest in nearly six weeks as investors considered the prospect of a release of crude supplies from strategic reserves.

Futures in New York closed down 3 per cent on Wednesday with both benchmarks dropping below their 50-day moving averages. President Joe Biden and his Chinese counterpart Xi Jinping discussed the merits of releasing oil from their reserves in a virtual summit Monday but didn’t make a decision, according to officials familiar with the discussions. In a letter on Wednesday, President Biden urged the Federal Trade Commission to probe possible illegal conduct in U.S. gasoline markets.

“Energy markets are waiting to see what, if any, coordinated efforts with the U.S. and China happen before placing bullish bets,” said Ed Moya, senior market analyst at Oanda Corp.

Crude has drifted in a range of about US$7 for the last six weeks, and traders are trying to figure out the market’s likely trajectory into 2022. The International Energy Agency said this week that while demand growth remains robust, supply is catching up. Meanwhile, the Organization of Petroleum Exporting Countries said a surplus may soon emerge as the rebound from the pandemic falters.

“When the trajectory of the oil market’s supply tightness is being challenged by both the IEA and OPEC, it’s difficult for the trading mood to not turn bearish,” said Louise Dickson, a senior oil markets analyst at Rystad Energy.

Prices:

- West Texas Intermediate crude for December delivery dropped US$2.40 to settle at US$78.36 a barrel in New York

- Brent for January settlement slipped US$2.15 to settle at US$80.28 a barrel

Japan, another major consumer that has voiced concern about high prices, is unlikely to release oil from its reserves due to a law that only allows it to release stocks in the event of supply disruptions, a government official said.

The U.S. Energy Information Administration earlier reported domestic crude inventories fell 2.1 million barrels last week and gasoline stockpiles slid 707,000 barrels. Yet, supplies at the nation’s biggest storage hub at Cushing, Oklahoma, edged higher.

“The market’s gaze has been distracted once again by the White House,” said John Kilduff, founding partner at Again Capital LLC. “We appear to be another step closer to a release, which is pressuring prices.”