Nov 22, 2022

Oil recovers after choppy session of OPEC+ supply speculation

, Bloomberg News

Oil is down but traders are ignoring supply threats: En-Pro's Roger McKnight

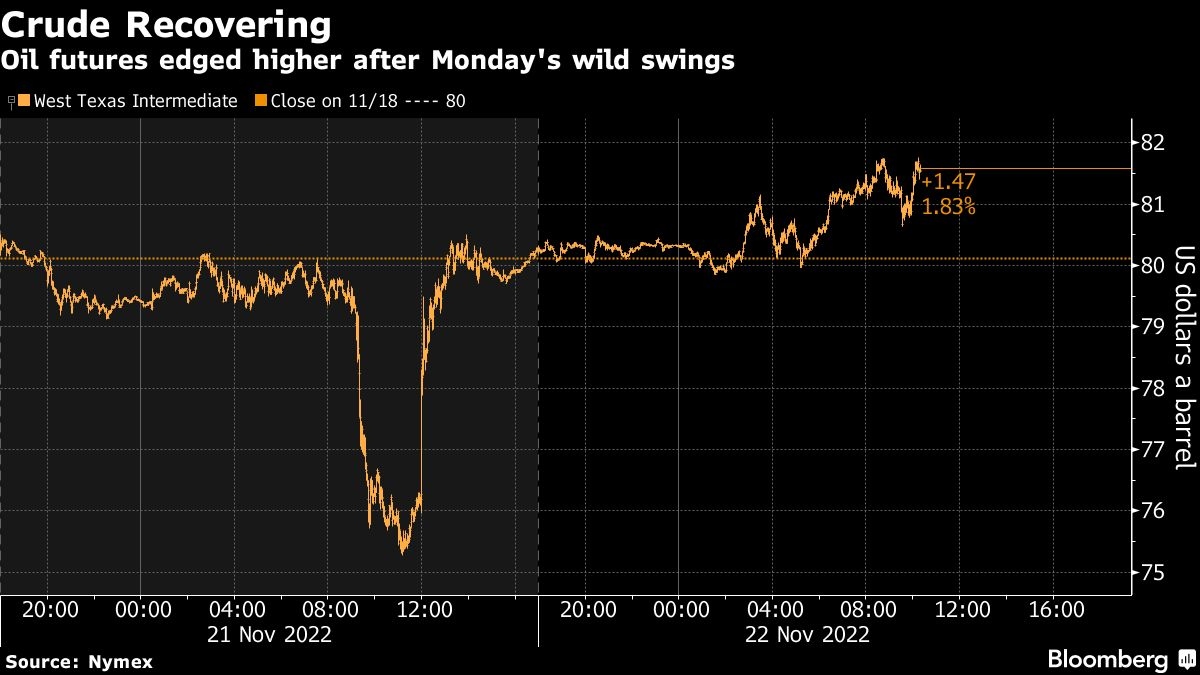

Oil rose after a choppy session on Monday as investors juggled an uncertain supply outlook with concerns that demand in virus-hit China will slip further.

West Texas Intermediate rose 2 per cent to trade above US$81 a barrel on Tuesday. Prices firmed after a bumpy session that saw crude briefly plunge on speculation OPEC+ was considering an output hike. Group leader Saudi Arabia and fellow Gulf producer Kuwait both rejected the suggestion, prompting a recovery. The dollar also fell on Tuesday, boosting commodities priced in the currency.

Covid concerns have led oil prices lower this month. Looming European sanctions on Russian flows -- and a Group of Seven price-cap plan -- have boosted uncertainty, with Chinese buyers pausing some Russian purchases. The cloudy outlook across the market has affected liquidity, with open interest for WTI the lowest since 2014.

“Crude is still in the process of reversing the OPEC rumor of production increases from yesterday,” said Dennis Kissler, senior vice president at Bok Financial Securities in an interview. “While China’s Covid issues are a concern, the price break the past two trading sessions was definitely overstated.”

Crude-consumption trends in China remain in the spotlight as repeated Covid-19 outbreaks prompt officials to press on with lockdowns and curbs on movement. Large swaths of the country’s economy are now subject to virus restrictions, hurting the outlook for demand just weeks after investors had speculated Beijing may be moving away from its zero-tolerance stance.

Prices:

- WTI for January delivery climbed US$1.59 to US$81.63 a barrel at 10:28 a.m. in New York

- Brent for January settlement advanced US$1.72 to US$89.17 a barrel.

High shipping costs have also started to weigh on pricing for actual barrels. On Monday, the industry’s benchmark route broke US$100,000 a day, adding to the pressure on physical crude markets against a backdrop of weak Chinese buying.