Feb 9, 2023

Oil halts three-day advance as caution counters the China bulls

, Bloomberg News

Futures market looks ugly for oil and gas: Robert Yawger

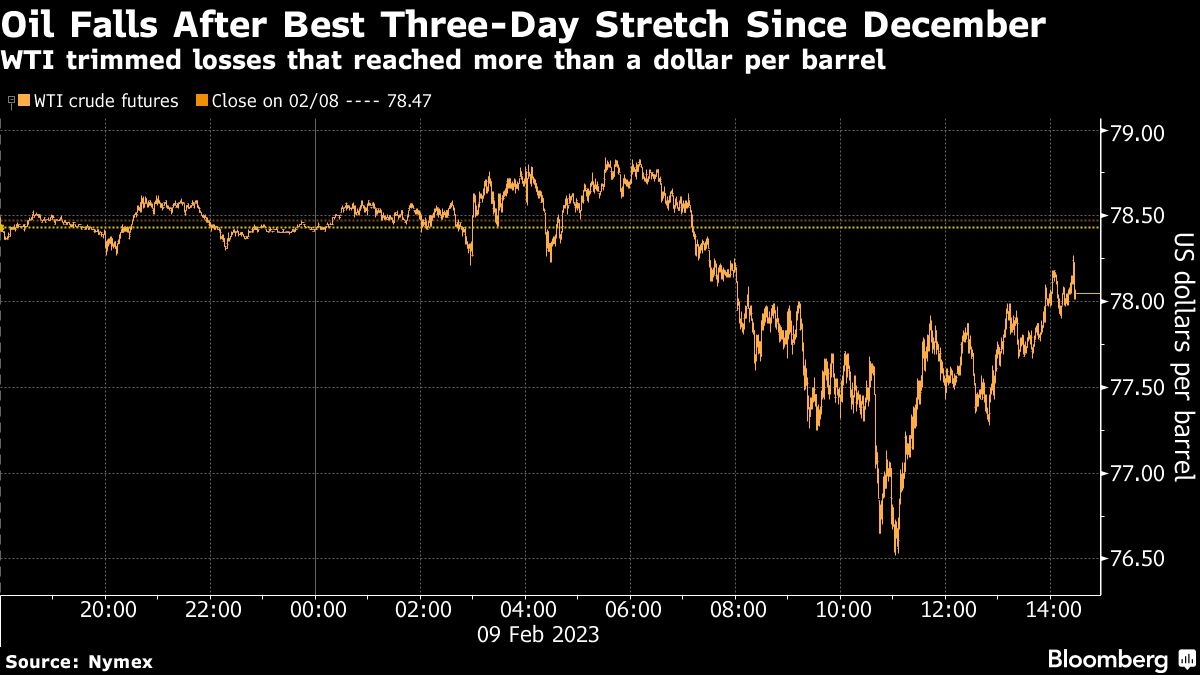

Oil backtracked after its best three-day stretch since December as headwinds from recession risks in the U.S. and Europe tempered optimism over China’s emergence from COVID-Zero policies.

“The push-pull has been ongoing since the start of the year, leaving the commodity having trouble breaking out of its range,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth. “Positioning looks set up long, so data will be the driver of moves to the upside.”

Prices have swung in a US$10 range since the start of 2023 with investors uncertain about the state of the U.S. economy and the extent of China’s rebound. Major banks have said they expect a Chinese recovery to drive prices to US$100 again but not until the second half of this year.

Better-than-expected flows out of Russia despite multiple energy export bans and a relatively mild winter in the northern hemisphere are keeping a lid on prices amid an uncertain economic backdrop in the U.S. and Europe.

Prices

- WTI for March delivery slipped 41 cents to settle at US$78.06 a barrel in New York.

- Brent for April settlement lost 59 cents to settle at US$84.50 a barrel.