Aug 10, 2022

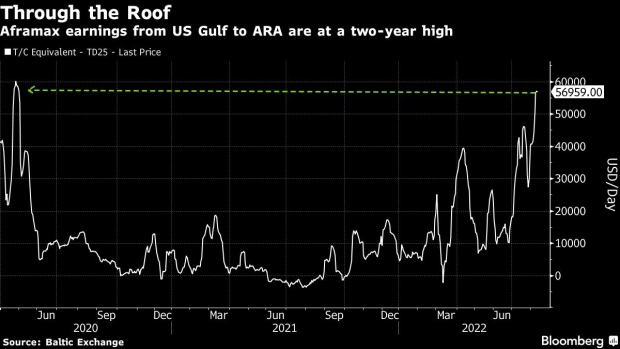

Oil Tanker Freight Rates From US to Europe Soar to Two-Year High

, Bloomberg News

(Bloomberg) -- Shipping costs for mid-size oil tankers from the US Gulf to Europe are near the highest levels since early in the pandemic, due to changes in trade flows amid Russia’s war in Ukraine and fewer available ships globally.

Daily earnings for Aframax vessels sailing from the US Gulf to northwest Europe have soared to almost $57,000 this week -- more than 12 times the level at the start of the year -- according to data from the Baltic Exchange. The tankers typically haul about 600,000 barrels of crude.

This followed a surge in rates for Aframaxes crossing the Mediterranean in late July, as traders raced to secure tankers when Libya resumed exports following months of halt at several key ports.

While Libyan exports reduced the availability of ships, the market had already been tight in recent months, after Russia’s invasion of Ukraine upended global oil flows. Russia’s flagship Urals crude, mostly shunned by European refiners, is now exported further away to Asia, while European refineries are trying hard to find alternative grades from the North Sea, West Africa and the US Gulf.

“Because of the reallocation of trade that’s had to take place, a lot more Aframax cargoes have been bringing crudes from elsewhere, like the US Gulf into Europe to replace lost Russian barrels,” said Richard Matthews, head of research at E.A. Gibson Shipbrokers Ltd.

The vessels are “optimally-sized” to dock at European ports, many of which cannot take supertankers, known in the trade as VLCCs, he added. “We’ve also seen a lot more North Sea crude, that might typically be parceled up onto VLCCs and exported to Asia, being loaded on Aframaxes and retained within the region.”

READ: Oil Tankers See Strongest Market in Decades on Thirst for Fuels

Aframax rates will likely remain elevated in coming months because global flows are unlikely to change significantly as long as sanctions against Russia are still in place, Matthews said, noting one caveat. That’s the threat of global recession, which could suppress demand for oil, thereby lowering tanker rates.

©2022 Bloomberg L.P.