May 1, 2020

Oil-Tanker Rates Crash as OPEC+ Cuts Near

, Bloomberg News

(Bloomberg) -- Oil tanker rates are crashing on the eve of a pact to limit global crude production. Don’t bet on the rout enduring.

From Friday, crude producers in the OPEC+ alliance will cut their collective output by a level that’s unprecedented in history -- almost 10% of global consumption. Normally, such huge curbs would have destroyed the tanker market almost as soon as they were announced a few weeks ago, as a dogfight broke out for a fast-diminishing pool of cargoes. But these aren’t normal times.

The coronavirus has wiped out so much oil demand that the world will still be over-producing on a huge scale. While that means fewer cargoes, which is bad for the owners, it also means a glut that must be stashed some place. And that place is often on supertankers because space in on-land tanks has already been booked up or filled.

“OPEC+ cuts would have led to rates crashing” down to about $9,000 a day, a level that just covers the ships’ running costs, said Frode Morkedal, an analyst at Clarksons Platou AS, a unit of the world’s largest shipbroker. Instead, the drop in cargoes will mostly just free up more tankers to act as storage vessels -- for which demand remains strong -- propping up freight rates.

Shares of Euronav NV, Frontline Ltd. and DHT Holdings Inc., three owners whose fleets are dominated by crude carriers, all slumped earlier in the week amid concern that the supply curtailments of 9.7 million barrels a day will ultimately hurt their earnings, and also because an oil-market incentive to store diminished.

Day rates to China from Saudi Arabia stood at just over $100,000 a day on Thursday, according to the Baltic Exchange. That represents a drop of more than 50% in the space of a week -- a big decline even by the volatile standards of the spot tanker business.

But tanker owners, and analysts who follow them, remain confident there won’t be the kind of wipeout that normally accompanies deep oil production cuts by the Organization of Petroleum Exporting Countries and its allies. By one estimate, as much as 35 million barrels a day of demand -- more than three times the output curbs -- has been lost because buying of transport fuels has been crushed by lockdowns to stop the spread of the coronavirus.

And despite becoming less favorable for tanker owners, the oil market’s forward curve is still offering deep incentives to store.

At the nadir of the oil market rout, Brent for the nearest month was trading at a discount of almost $14 a barrel compared to supply in six months’ time. For a supertanker cargo of 2 million barrels, it implied a gap of $28 million, meaning potentially big profits for traders if they could book storage for less than that. Since then, the per-barrel spread has narrowed to about $8 a barrel, but that’s still $16 million for a supertanker cargo.

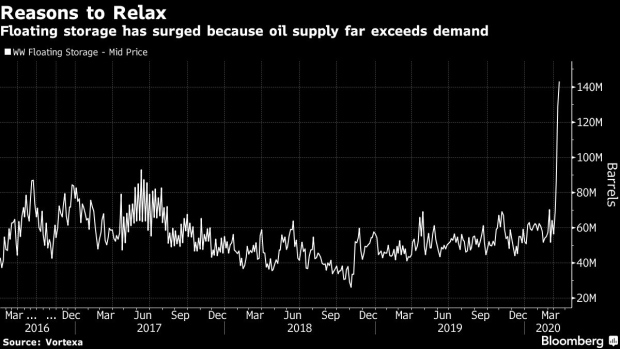

There are now 143 million barrels of crude oil in floating storage, according the most recent data on Bloomberg from Vortexa Ltd., an oil and shipping analytics firm. That’s the highest since at least early 2016, and quite possibly an all-time record. Traders also placed well over 100 million barrels on ships during the 2008-09 recession.

Euronav, which reports first-quarter earnings next week, said that demand for tankers to be deployed for floating storage remains strong.

Do The Contango

“Investors and the stock market are pricing in data points as they emerge so the contango spread reduces tanker share prices sell off; contango spread increases so share prices rise,” said Brian Gallagher, Euronav’s investor relations manager. “The demand for storage remains well underpinned for economic profit and increasingly for logistical reasons.”

Clarksons Platou estimates that, were it not for floating storage, the hit to tanker demand from the output cuts would slash the tanker fleet’s utilization rates by 21 percentage points to 79%, and that day rates would tumble to levels of about $9,000 -- roughly what supertankers need to cover their running costs.

However, the continued overproduction of oil and traders’ consequent need to keep storing barrels on ships will see that utilization rate at about 90% by late June -- a level that’s still very high by historical standards and will support day rates as high as $75,000 a day, according to Morkedal.

Oil on Water

Frontline Ltd. boss Robert Hvide Macleod says ships will keep storing and the amount of oil on the water -- up 18% this year by his reckoning -- will keep on rising even when the output cuts do start to result in fewer cargoes.

“Oil on water is steadily increasing,” he said. “This is likely to continue as the world produces far more oil than the world consumes, which has a positive effect on tanker rates. Simply put, we expect the oil on water increase to outpace supply cuts. Oil-on-water statistics captures storage, congestion, slow steaming and we find it a very good indicator.”

Earnings for very large crude tankers, known as VLCCs, on the benchmark route from the Middle East to China have been been at high levels since early March because of a battle for market share among major crude producers at a time when demand was being crushed by Covid-19.

They peaked this year at $250,000 a day on March 16, but even rates of $100,000 are very high by historical standards.

“We believe the steep contango in Brent crude prices will continue due to Covid-19 demand destruction, which will further support floating storage demand and tanker rates,” said Randy Giveans, senior vice president for equity research at Jefferies LLC in Houston.

©2020 Bloomberg L.P.