Mar 9, 2020

Oil Traders Seek Out Storage at Sea After Crude Prices Collapse

, Bloomberg News

(Bloomberg) -- Oil’s plunge has revived memories of the 2008-09 recession, when traders snapped up dozens of tankers to park unwanted barrels at sea.

Brent futures for May collapsed as much as 32% on Monday after Saudi Arabia began offering its crude at deep discounts, stoking immediate concerns of an oil-price war. On Friday, the kingdom and its allies in OPEC failed to secure Russia’s participation in a pact to limit global supply.

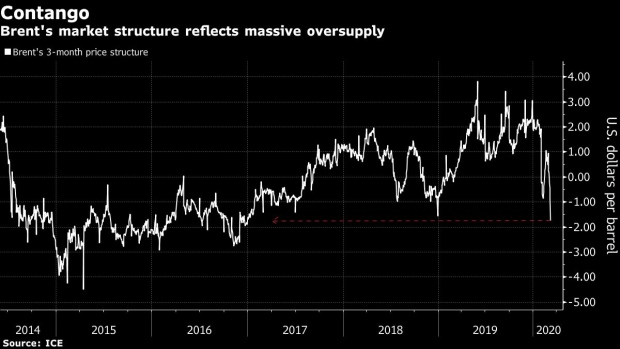

The rout has raised the prospect of traders keeping oil at sea for later sale at a profit. In the height of the 2008-09 recession, oil companies, traders and financial institutions kept more than 100 million barrels on tankers, some betting on a rebound, others simply locking in a so-called contango, where month-on-month price oil-price gaps far exceeded the cost of hiring vessels.

“The oil curve has moved in to contango or carry, prompting oil traders and majors to request offers for storage,” said Robert Hvide Macleod, the chief executive officer of Frontline Management, which runs the fleet of one of the world’s largest tanker companies. “How much actually gets done, the next few days will show.”

Brent futures for May were down 20% at $35.99 a barrel at 10:36 a.m. in London. Contracts for August were almost $2 a barrel higher than that, equating to a difference of nearly $4 million for a 2 million-barrel supertanker cargo between the two months. Current day rates for a three-month charter -- about $30,000 for an older supertanker -- would work out at about $2.7 million, even if there are significant additional costs involved in booking a vessel.

Traders and shipbrokers said that owners were reticent about accepting multi-month storage charters and that the number of suitable vessels available was limited. Ships can lose trader approvals if they’re stationary for long periods, and their hulls can need cleaning after long-periods without moving.

DHT Holdings Inc., another owner, has seen “several inquiries” about the use of tankers for floating storage, co-CEO Svein Moxnes Harfjeld said by email.

“A number of oil companies are already looking to time charter or purchase older VLCCs to use as floating storage units,” said Henry Curra, head of research at Braemar ACM Shipbroking, referring to very large crude carriers that typically haul 2 million-barrel cargoes.

On Friday, Saudi Arabia-led OPEC failed to agree with allied producers including Russia on supply curbs to avoid a glut. The Organization of Petroleum Exporting Countries had proposed a 1.5 million barrel a day reduction, but failed to get Russia’s participation. Then, on Saturday, Saudi Arabia began offering its barrels at deep discounts to benchmarks, triggering speculation a price war has begun.

“Traders are asking a lot of questions this morning” about booking tankers to keep crude at sea, said Halvor Ellefsen, a London-based shipbroker at Fearnleys A/S, echoing comments from several traders and brokers. “At the moment, it’s opportunistic: they know they may well need the capacity to store barrels.”

--With assistance from Jack Wittels.

To contact the reporters on this story: Serene Cheong in Singapore at scheong20@bloomberg.net;Sharon Cho in Singapore at ccho28@bloomberg.net;Alex Longley in London at alongley@bloomberg.net

To contact the editors responsible for this story: Alaric Nightingale at anightingal1@bloomberg.net;Serene Cheong at scheong20@bloomberg.net

©2020 Bloomberg L.P.