Dec 3, 2021

Oil Traders Stampede to the Exit After Dizzying Volatility

, Bloomberg News

(Bloomberg) -- Oil traders and investors are shutting down their books at a rapid pace, after a remarkable period of year-end volatility

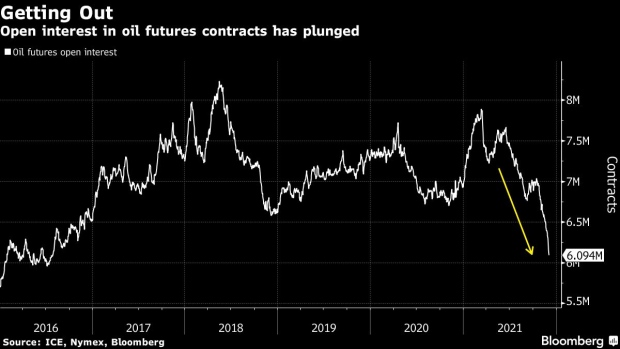

Combined open interest in four Brent and West Texas Intermediate contracts, alongside the primary gasoline and diesel futures has plummeted to its lowest level since July 2016, according to exchange data compiled by Bloomberg. Almost a million futures contracts -- equivalent more than 850 million barrels of oil and fuel -- have been liquidated since prices neared multiyear highs in mid-October.

The decline has accelerated in recent days, after crude last Friday shed $10 in a single day, and has whipsawed again throughout this week. Those moves have pushed market volatility to its highest since prices went negative last year, and to some of the highest levels ever.

Investors “don’t want to go on holiday and come back and oil is down 30%, this is just too high octane,” Christyan Malek, head of EMEA oil and gas research at JPMorgan Chase & Co. said in a Bloomberg TV interview. As a result the market is currently stuck in a “kind of paralysis,” he said.

Previous bouts of extreme volatility have led to collapses in activity. When prices turned negative in April last year, trading volumes collapsed in the months that followed as some traders shied away from the risks of holding a contract that could go below zero.

©2021 Bloomberg L.P.