Mar 30, 2023

Old-School Voice Brokers Make Comeback in $9 Trillion JGB Market

, Bloomberg News

(Bloomberg) -- A stirring in the bond market brought on by the Bank of Japan is starting to create jobs in one corner of the market that has long been suffering: voice brokers handling interbank trading.

Central Totan Securities Co., one of Japan’s few remaining domestic government bond brokers which help execute trades among financial institutions, is planning to hire several workers to handle the increased business. The Tokyo-based firm, which has around 20 voice brokers currently, is now looking to add as many as three people including widening the net to include inexperienced hires, the first time it’s doing so in its 26-year history.

Speculation over BOJ policy changes is bringing the country’s $9 trillion government bond market back to life, and with it more business for Central Totan. The trading volume of coupon-bearing JGBs increased to 88.7 trillion yen ($669 billion) per month in the fiscal year 2021 from 80.6 trillion yen the year before, according to a report by the finance ministry. A gauge of JGB volumes calculated by Bloomberg reached the highest since 2014 last year. Meanwhile, volatility in JGB prices is also hovering around a decade high.

“I feel there have been cases where we rather became short of manpower in a lively market and ended up losing some business,” Yuichi Takahashi, an executive director and general manager of sales headquarters and JGB division at Central Totan, said in an interview. “We are managing to handle transactions through teamwork for now, but there could be some difficulties if their volume grows more and more.”

Possible Awakening

The development underlines how the awakening of JGB trading is turning the table for professionals who for years have struggled with the absence of volatility, a product of heavy central bank intervention. Trading volumes for the brokers fell dramatically as the BOJ bought up JGBs as part of its ultra-easy monetary policy.

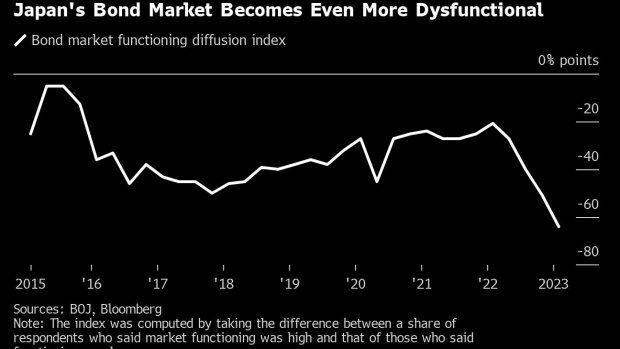

Even now, Japan’s bond market is deeply dysfunctional as massive BOJ purchases hoover up liquidity along the curve – the central bank owns about half of all sovereign debt. A gauge measuring bond market functioning, based on a quarterly survey of market participants, fell to a fresh record low in February.

For the voice brokers, they never really went away even with the advent of electronic trade, since their services allow clients to transact JGBs without orders showing up on screen beforehand.

At Central Totan, its trading room now comes alive once every 10 to 15 minutes when there’s a JGB transaction. Voice brokers sit in a dealing room with walls of whiteboard where information on JGBs being traded is hand-written on. When a client calls with an order, the broker who gets it shouts it out, and colleagues immediately start speaking into microphones to match prices with other customers to close a deal.

Until recently, the room could sometimes remain silent for over an hour as the brokers awaited business, Takahashi said. The firm lost money for the third straight year in the year ended March 2022 even though the size of losses shrank, according to its latest available filings.

“There were times when our brokers were sitting quiet,” he said. “When the market expands, we too want to.”

Beyond these brokers, hedge funds have also been hiring seasoned JGB traders from investment banks as portfolio managers, while both Japanese and non-Japanese financial firms are seeking to recruit JGB market-makers, according to Yoshiki Kumazawa, financial services recruitment director at Morgan McKinley Group Ltd.

“Companies have moved over the past year or so to reinforce their staffing as increased JGB volatility has opened business opportunities,” Kumazawa said.

--With assistance from Cormac Mullen, Masaki Kondo and Kana Nishizawa.

©2023 Bloomberg L.P.