Apr 16, 2021

Once-Bullish Wizz Air CEO Says His Optimism for Summer Is Fading

, Bloomberg News

(Bloomberg) -- Wizz Air Holdings Plc Chief Executive Officer Jozsef Varadi said he’s no longer counting on a rebound in European travel this summer as travel restrictions persist and vaccine rollouts stutter.

Uncertainty over the easing of curbs make it impossible to predict levels of demand in three or four months, and whether an envisaged increase in capacity to between 70% and 80% of pre-pandemic levels is justified, Varadi said in an interview Thursday.

“We need to reconcile these numbers with reality,” he said. “It might be possible to operate within these ranges, but we can’t guarantee it. It’s not a matter of capacity planning but governments imposing restrictions.”

Wizz’s assessment of prospects for the vital summer season, during which European airlines make most of their money, is in line with increasingly conservative projections from analysts. But it contrasts with a more optimistic view from EasyJet Plc, which said Wednesday it’s ready to ramp up operations and most countries are set to resume flying “at scale” in May.

Varadi said that while he’s confident there will ultimately be a rebound given pent-up demand, “whether this will happen over the summer or the winter or next spring, we don’t know.” Budapest-based Wizz said in a statement it expects “only a gradual traffic recovery into late summer.”

Europe has been much more restrictive with air-travel than anticipated, the CEO said, citing the U.K.’s dithering over which destinations will feature in a May 17 restart, together with fallout from delayed vaccination programs on the continent that “could take them a year to catch up.”

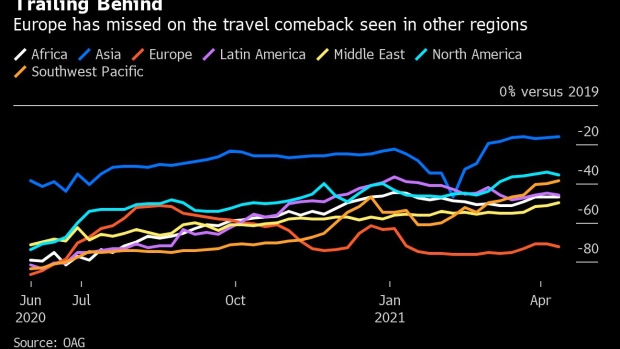

The region has also been slower to restore services than North America and Asia because its numerous geographically small countries have a lower proportion of domestic flights unaffected by border curbs. Atlanta-based Delta Air Lines Inc. reiterated Thursday that it expects to turn profitable in the third quarter, buoyed by leisure trips and a pickup in domestic business travel.

Wizz, listed in London and backed by Bill Franke’s Indigo Partners, still intends to be aggressive in targeting market share where opportunities arise and plans to stick with all of its 40-plus bases, Varadi said.

The carrier also has no plans to reduce deliveries from Airbus SE, with 27 new A320-series narrow-bodies due in the next 12 months, though there’s flexibility to return existing jets to lessors or renegotiate terms as contracts expire.

Wizz’s 1.6 billion euros ($1.9 billion) of liquidity should last it for approaching three years at current levels of cash burn, the CEO said, and there are no plans to raise further funds.

©2021 Bloomberg L.P.