Mar 17, 2022

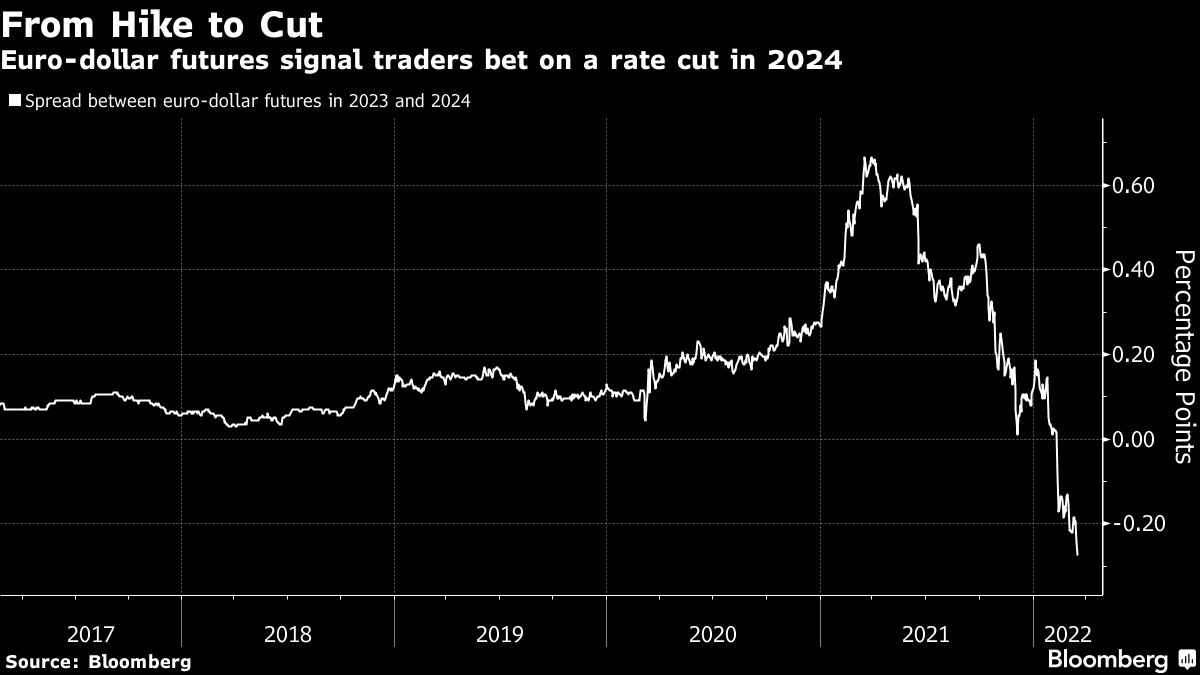

One day after U.S. Fed hike, traders are betting cuts will start in 2024

, Bloomberg News

U.S. Fed’s view is too optimistic: RBC Capital Markets’ Tom Porcelli

Just one day after the Federal Reserve kicked off its cycle of interest-rate increases, traders are speculating the central bank will start easing monetary policy again in less than three years.

The implied yield on December 2024 eurodollar futures is 2.39 per cent, or 28 basis below the year-earlier contracts, indicating that traders expect the Fed’s benchmark rate will be cut over that time. The gap was 0.2 per cent on Tuesday before the Fed policy meeting and was at zero as recently as in February.

The pricing reflects the risk that a series of aggressive interest-rate hikes aimed at slowing inflation will weaken economic growth or even tip the economy into a recession. That concern is evident in the Treasury market, where the gap between 5- and 10-year yields has collapsed, signaling expectations that growth will slow.

The Fed boosted its key rate to a target range of 0.25 per cent to 0.5 per cent Wednesday. In its so-called dot plot, officials’ median projection was for the benchmark rate to be increased to 1.9 per cent by the end of 2022, hit about 2.8 per cent in 2023 and remain steady in 2024.