European Real Estate Deals Slump to Lowest Level in 13 Years

The deep freeze that’s gripped Europe’s real estate markets since borrowing costs jumped worsened at the start of the year as deals plunged to their lowest levels since 2011.

Latest Videos

The information you requested is not available at this time, please check back again soon.

The deep freeze that’s gripped Europe’s real estate markets since borrowing costs jumped worsened at the start of the year as deals plunged to their lowest levels since 2011.

Investors are looking for the next policy domino to fall in Asia amid an escalating campaign against a resurgent dollar, after Indonesia used a surprise interest rate hike to defend the rupiah.

Vietnamese billionaire Pham Nhat Vuong pledged to invest at least another $1 billion of his personal wealth into VinFast Auto Ltd., providing the capital needed for expansion of the struggling electric vehicle maker.

Macrotech Developers Ltd., a real estate firm that operates under the brand name Lodha, expects pre-sales to grow about 20% in the year to March after reporting its highest ever quarterly revenue.

Distressed Indonesian property developer PT Agung Podomoro Land has hired financial advisory firm Kroll Inc. to advise on an exchange of $132 million of bonds due in June, according to people familiar with the plan.

May 15, 2017

, BNN Bloomberg

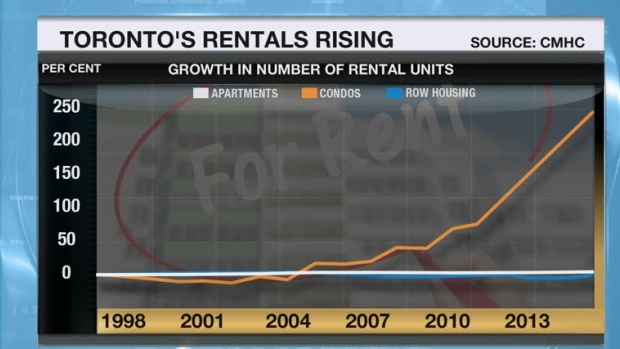

Ontario’s new rent control measures are targeting the wrong end of the hot housing wave sweeping the Golden Horseshoe, according to the CEO of Canada’s largest real estate investment trust.

“They’re solving a problem that I’m not really sure existed,” RioCan REIT CEO Ed Sonshine told BNN on Monday.

“It can’t be helpful to what we’re doing because we really had to go back – and we’re in the process of doing that - and re-evaluate every project we have,” he said.

Ontario announced a spate of new housing measures on April 20 on the heels of a summit between Toronto Mayor John Tory, Ontario’s Finance Minister Charles Sousa, and federal Finance Minister Bill Morneau.

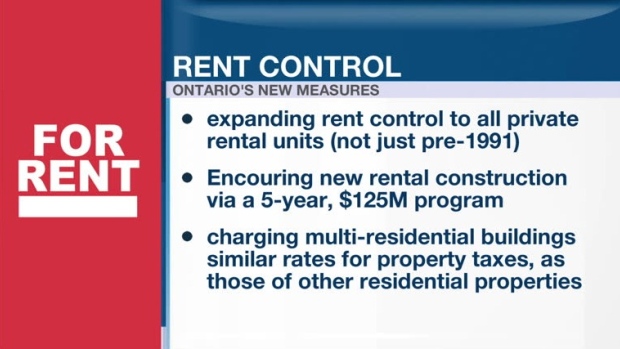

Included in those measures was extended rent control to properties built after 1991, altering the property taxes on apartment buildings to bring them to the same rate as residential properties and the launch of a new five-year $125 million rental construction program.

Sonshine told BNN that instead of lowering rents around the city, the planned measures could deter the construction of new apartments in the city, with developers opting for one-time sale endeavors, like condominiums, instead of building units which will continually require new tenants as the years pass.

“It probably won’t affect the going-in yields, the day one yields much - it will effect that a little bit – [but] it may impact what you’re going to build,” he said.

“If their purpose was to encourage more new affordable housing in the purpose-built rentals side, I don’t, quite frankly, see how it can do that. They need some tweaks that will encourage new construction.”

Sonshine does, however, see an upside to the new measures for his own company.

“There will probably be less competition,’ he told BNN. “We’re able to take a long-term view of things and –more important[ly] - we already own the land. We’re typically only building by and large where we already own the property.”

“Already owning the land, you don’t have the big cost risk that somebody does having to come in and buy the land at today’s prices.”