Apr 3, 2023

OPEC+ cut complicates falling inflation outlook: Larry Berman

By Larry Berman

Larry Berman's Educational Segment

Consumer sentiment for inflation expectations is often reflected by the most recent trip to the gas pump and supermarket. For an increasing number of people that trip is to Costco or Walmart where your dollar lasts longer. For the lower income cohorts, higher energy costs are a pure tax on discretionary consumption. To be sure, this is bad for economic growth and earnings and is not a reason to be bullish on equities. The inevitable credit contraction that will certainly follow from the trend of deposit migration (that started in 2022) to higher yielding savings vehicles is not a reason to be bullish on equities. If the reason for this current equity rally is that inflation expectations are falling, then this move by OPEC+ likely complicates that narrative.

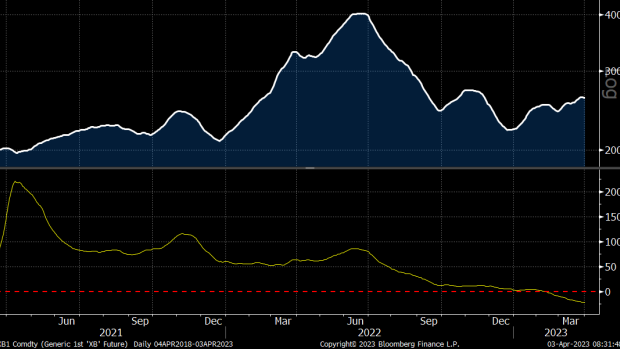

The first chart to consider is the price of gas (U.S. cents per gallon) and its future inflationary impact. Unleaded gas futures are the raw price while the price you pay at the pump adds various taxes. Assuming that OPEC cuts are able to overcome the fall in demand from a hard U.S. economic landing, we will start to see energy prices again add to inflation pressures starting in the fall. Gasoline prices have been subtracting from inflation since late December. This will likely make it harder for the Federal Open Market Committee (FOMC) to cut rates later in the year unless the economic pain is much greater in terms of job losses. This is not bullish for equities or earnings (other than perhaps oil producing energy companies).

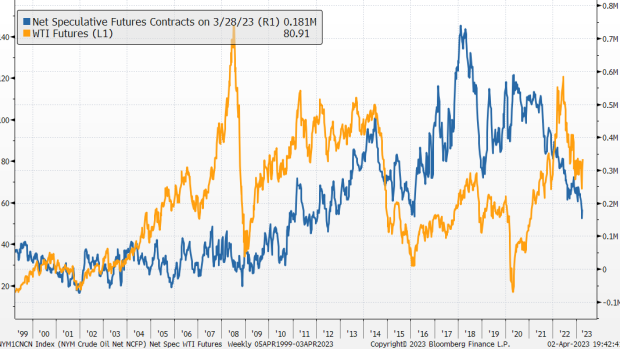

One potential bullish catalyst for energy markets to rally is the positioning by speculators in the futures market. Speculators are always almost net long while commercials (producers of crude) are almost always net short (they need to sell or hedge the oil they produce). The degree changes over time. There is no specific level to look at, it’s about the change in behaviour or trend that matters. Speculators have been reducing bullish exposure for the past year, which means that producers have been buying back their hedges. A low net reading from speculators is a huge potential source of demand. So despite all the bullish narrative coming from the energy sector about low investment and future supply, speculators have been reducing positions. To us, this speaks to the recessionary outcome being a much higher probability looking forward. We will see if the supply cut can motivate the speculator to get back in the market. Chatter is that Saudi Arabia was upset at the Biden plan to delay filling the Strategic Petroleum Reserve (SPR). Geopolitics and shrinking global cooperation will likely add to underlying core inflation pressure. Some recent contracts for crude oil delivery have been priced in Chinese RMB by Brazil and Russia in part to avoid the U.S. dollar and sanctions. If the U.S. dollar loses some of its global hegemony, that is likely to add some core commodity price inflation too.

We hate to say Mr. Market is wrong, but if you are forecasting, you should look through the index to see what is happening on average. For the S&P 500, excluding the five big tech names, the market is down this year. The weakness started after the January rally and the FOMC pounded home the narrative of higher rates for longer. Post banking crisis, this message has not changed, though concern about credit contraction has entered the FOMC’s equation. To us, this increases a hard landing scenario, not their ability to engineer a soft landing. Core I nflation needs to fall to below three per cent, or the economy needs to break into a hard landing for the FOMC to cut rates in our view as the market has priced in. This would be bullish for equities if the full bear scenario was already priced into equities. Current valuations and earnings expectations are still pricing in a soft landing outcome, which seems less and less likely.

So investors that have been trained on buy the dip have been selling everything to buy big cap tech. This rotation to perceived safety is often the last relief rally before the bear takes hold again. And it’s making the market cap weighted indexes look better than the economy and earnings outlooks are likely to be. Message to investors, be cautious, this is not likely the economic turn that moves us back into a bull market.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com