Jun 1, 2023

OPEC+ Faces Oil Market Torn by Demand Rebound and Recession Fear

, Bloomberg News

(Bloomberg) -- OPEC+ will be grappling with a divided oil market when it meets this weekend.

On one side, global oil inventories are shrinking as the alliance’s latest production cuts take effect. On the other, disappointing Chinese economic indicators and fears of a US recession have emboldened bearish speculators.

The split picture is mirrored by mixed signals from the cartel’s leaders. Coalition leader Saudi Arabia has warned short-sellers to “watch out,” in contrast to more moderate comments from Russia.

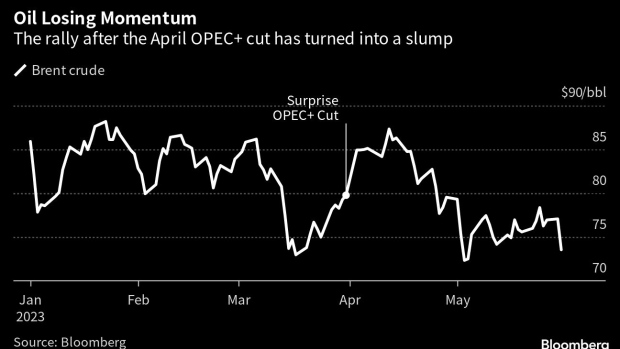

At stake is the direction of oil prices and their impact on inflation. Crude has retreated 17% in the past six weeks to trade near $73 a barrel in London, but is still predicted to pick up again in the second half.

“With prices at this level, OPEC is caught between a rock and a hard place,” said Raad Alkadiri, managing director at Eurasia Group. “It is the anti-Goldilocks zone: prices not low enough to dictate a cut, but not high enough for OPEC’s fiscal comfort.”

The 23-nation OPEC+ alliance convenes in Vienna on June 4, just a month after starting to implement their 1.2 million barrel-a-day production cutbacks unveiled in April.

Those curbs, which will be maintained all year, should be enough to deplete stockpiles substantially as consumption rises in China and beyond, analysts predict. Data from the Organization of Petroleum Exporting Countries suggest a hefty shortfall of about 1.5 million barrels a day in the second half.

These numbers suggest another round of production curbs wouldn’t be welcomed by countries that are still feeling intense cost-of-living pressures. President Joe Biden’s administration criticized OPEC+ for its April cut and the International Energy Agency has condemned the group for exacerbating the “siege” on consumers.

While prices have fallen recently, the group isn’t under severe fiscal pressure. Crude may be below the $81 a barrel that the International Monetary Fund believes Saudi Crown Prince Mohammad bin Salman needs for his ambitious plans of economic transformation and futuristic cities in the desert, but it’s well above the lows seen during the pandemic.

“OPEC has never cut within three months of a previous cut with stocks as low as today,” said Daan Struyven, an economist at Goldman Sachs Group Inc. “They likely first want to observe the impact of fresh cuts which just started.”

Russian Doubts

Riyadh and its allies also may be reluctant to undertake extra measures until they have more clarity on supplies from fellow OPEC+ member Russia.

Moscow has pledged to slash output in retaliation for international sanctions over its invasion of Ukraine, but there’s little sign that it’s following through. The country is withholding official production figures, and tanker-tracking data show exports are up 8% from February at about 3.6 million barrels a day.

Russia’s Deputy Prime Minister Alexander Novak said his country fully implemented its 500,000 barrel-a-day cut in May, something he initially pledged would happen back in March.

“The real issue is can the Saudis corral Russia?” Paul Sankey, lead analyst at Sankey Research LLC, said in a Bloomberg television interview. “Russia’s a threat to Saudi, because what Russia’s doing is sending its oil to Asia,” eroding the price premium that Riyadh’s barrels normally command there, he said.

Bear Attack

Twenty-five out of 31 traders and analysts surveyed by Bloomberg last week forecast that OPEC+ will keep production levels unchanged. Several delegates from the group, who spoke on condition of anonymity, also said they expect the status quo. Russia’s Novak similarly predicted no changes, though later qualified his remarks to say the group could still take action if it was needed.

Even so, the fundamentals of supply and demand aren’t the only driver of OPEC+ oil policy.

When Saudi Arabia unveiled the surprise cutbacks in April, Energy Minister Prince Abdulaziz bin Salman said they were intended to scare off short sellers who had built up an excessively large positions.

It was a tactic the kingdom has used several times in recent years, and the prince said last week that short sellers risk another “ouching.” His statement initially deterred the bears, but they have since returned, dragging Brent futures down by a further $5 a barrel.

A muted economic rebound in China — the world’s largest oil importer — along with its faltering equity markets and reluctance to deploy large-scale stimulus could convince Riyadh that intervention is necessary. Morgan Stanley, which once led Wall Street’s calls for the return of $100-a-barrel crude, says the widely-held belief in a tighter market this year is misguided.

A face-to-face OPEC+ meeting in Vienna gives the Saudis another opportunity to show their resolve and “does raise the prospect that the group could decide to do a deeper cut,” said Helima Croft, RBC Capital Markets LLC’s head of commodities strategy in New York.

--With assistance from Ben Bartenstein, Nayla Razzouk, Sharon Cho, Fiona MacDonald, Olga Tanas and Dina Khrennikova.

©2023 Bloomberg L.P.