Jun 21, 2022

Options Traders Start to Sweat Over Potentially Wild Yen Rally

, Bloomberg News

(Bloomberg) -- The fundamentals may be stacked against the under-pressure yen but traders are still willing to bet on a sharp move higher amid the risk of a global recession or an unlikely Bank of Japan policy change.

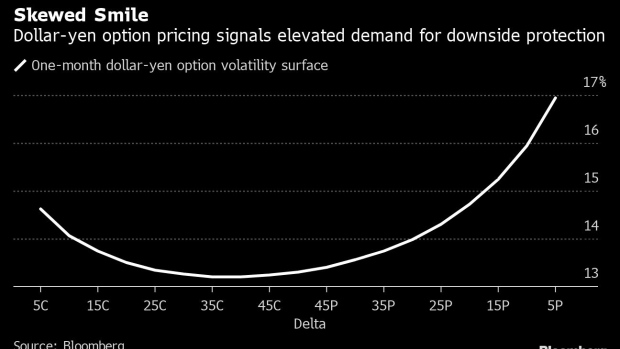

Highly speculative one-month dollar-yen put options cost over two percentage points more than equivalent calls -- a sign of increased demand for bullish yen bets, according to data compiled by Bloomberg. The so-called delta 5 out-of-the-money options are seen by traders as having only about a 5% chance of being exercised before expiring.

Caught in a vice grip between a Bank of Japan keeping rates pinned to the floor to boost the local economy and a Federal Reserve hiking aggressively to rein in sky-high inflation, the yen has slumped to a 24-year low against the dollar. But the currency is still seen as an undervalued hedge by the likes of Goldman Sachs Group Inc. and Societe Generale SA against the risk of recession amid global policy tightening.

And at the back of investor minds is the possibility that the BOJ will eventually have to do a U-turn and tweak its super-easy monetary policy, something it doubled down on at its meeting last week. That would likely lead to a sharp fall in the dollar-yen, as traders reprice the likelihood of any Japanese rate hikes.

SocGen derivatives strategist Olivier Korber sees value in buying one-year put options on the dollar-yen at a 115 strike, financed by the sale of those with a 110 strike, according to a research note Monday. Japan’s currency traded around 135 per dollar in Asia trading Tuesday.

“Dollar-yen could collapse in a hard-landing scenario,” Korber wrote. It “is still trading close to its tops, offering an attractive entry point to hedge portfolios with out-of-the-money puts.”

©2022 Bloomberg L.P.