Mar 23, 2023

Orban Opens New Front in Clash Over Hungary’s 18% Interest Rate

, Bloomberg News

(Bloomberg) -- Hungarian Prime Minister Viktor Orban moved to curb the central bank’s ability to tighten monetary policy, escalating a standoff with policy makers who are trying to rein in the European Union’s fastest inflation.

The restrictions, published in a decree published late Wednesday, stepped up government efforts to effectively loosen monetary conditions to help the economy recovery from an ongoing recession. The central bank has resisted pressure to cut its EU-high 18% key interest rate, saying its priority is to slow inflation.

Orban and central bank Governor Gyorgy Matolcsy, close allies until recently, have sparred publicly over the direction of monetary policy, trading blame over annual price growth exceeding 25% and a wobbly forint that’s been one of the most volatile globally in the past year.

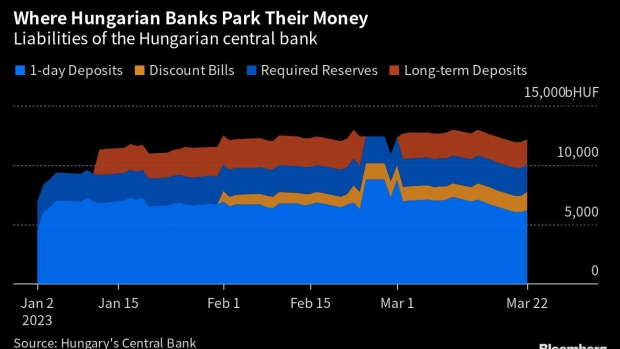

In the latest steps, the government barred big local investors and retail banks from putting cash in central bank credit facilities carrying 18% interest. The cabinet also extended a ceiling on interest that commercial banks can pay on deposits until end-June, which it said was aimed at eliminating a loophole benefiting high-net worth clients.

“The cost of many government decisions exceed their benefits, but they can be corrected,” Matolcsy said on Thursday at a book presentation, according to the Novekedes.hu website, in the latest barbed comment against Orban’s administration.

The government decree was published less than a week before the central bank holds a highly-anticipated policy meeting on March 28, where it will issue new inflation forecasts and provide guidance for the future direction of borrowing costs. Policy makers have said the 18% key interest rate is needed to rein in inflation and anchor the forint.

The currency shook off the government’s moves, gaining 0.7% to 384.7 per euro by 2:01 p.m. in Budapest, the biggest daily gain among European emerging-market currencies. It’s been one of the favorite carry-trade investments, where traders buy assets backed by higher interest rates, such as in Hungary, with loans made in lower-yield environments.

“For now, profit seems to be more important for investors than political risks, as we would have seen an adverse market reaction by now,” said Peter Virovacz, an economist at ING Groep NV in Budapest.

The latest curbs may have a limited impact on the forint, as they don’t restrict foreign institutional investors’ unfettered access to the central bank’s one-day deposit facility via foreign-exchange swaps with Hungarian lenders. They may even strengthen the forint by reducing local yields, cutting the cost of foreign-currency swaps and boosting profit on carry trades, Virovacz said.

Orban, who’s presided over large-scale state interventions in the economy since 2010, has used his powers to effectively ease monetary conditions, including by launching government subsidized corporate loan programs and capping mortgage interest rates.

The latest curbs affect the central bank’s twin credit facilities, which have a one-week and one-month maturity, respectively, and which have helped managed liquidity and to tighten monetary conditions along with the main one-day deposit facility.

They also cap the rate commercial banks can pay on short-term deposits at the average yield on three-month government Treasury bills, which are currently below 15%, compared with the 18% key rate.

--With assistance from Mark Sweetman.

(Updates with central bank Governor comment in fifth paragraph.)

©2023 Bloomberg L.P.