May 22, 2019

Oriflame Gets $1.3 Billion Offer From the Jochnick Family

, Bloomberg News

(Bloomberg) -- Oriflame, a Swedish cosmetics company that does much of its business in developing markets, has received an offer valuing it at $1.3 billion from the Jochnick family that founded it back in the 1960s.

By proposing a 35% premium over Tuesday’s closing price, the family is hoping to build on the roughly 30% stake it already has in Oriflame and take the company private. The goal is to push through a “re-positioning” that the Jochnicks argue is better done away from the glare of the stock market.

But the proposal doesn’t take into account the company’s potential, and means smaller shareholders will miss out on the restructuring gains that are buried in the stock, according to Joakim Bornold, a savings adviser at Soderberg & Partners.

“The bid feels a bit ungenerous right now,” he said by email. “The shares have dropped considerably lately, and are very far from their all-time high.”

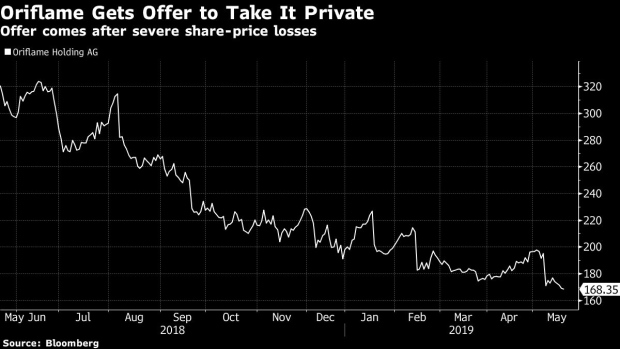

About a year ago, one Oriflame share traded at a high of 419 kronor, compared with Tuesday’s close of 168 kronor. The Jochnicks are offering 227 a share.

“I understand that the owner family sees a good opportunity to buy out the company right now, to make the big changes that are required,” Bornold said. “If they succeed, then Oriflame will likely return to the stock exchange, but” it will be “much more expensive.”

Read the details of the offer here

The proposed deal comes after Oriflame lost roughly a tenth of its market value since the beginning of the year. That followed a slump of more than 40% in 2018. Walnut Bidco, the company created by the Jochnick family to push through the deal, “will not” increase the offer price, it said in the statement. They need shareholders representing at least 90% of the stock to agree to the deal for it to be successful.

“It’s a gloomy development that the stock exchange increasingly loses these restructuring cases to the private environment,” Bornold said. “It’s a sign of weakness for the stock market. The losers are the smaller shareholders.”

Frida Bratt, a savings economist at Nordnet in Stockholm, says it’s likely that a lot of Oriflame investors are “tired of the share-price pressure and want to sell.”

“But at the same time, there are investors more willing to take risk, that see the low valuation and a chance of recovery,” she said. “From that perspective, there is a risk that a premium of 35% will not be enough for the bid to go through.”

The announcement comes as other corners of the cosmetics industry are forced to consolidate to deal with a tougher retail environment. Natura Cosmeticos, a Brazilian company that owns The Body Shop, is buying Avon Products in a deal valuing it above $2 billion, the Financial Times reported on Wednesday.

Bratt says the Jochnick offer is understandable because “the stock market’s judgment can be quite tough on companies where profitability falls over a period.”

“A lot of misery has already been priced into the share,” she said.

Alexander af Jochnick, the chairman of Oriflame, said the family’s decision to buy back the company follows on from its “strong sense of responsibility” as the main shareholder.

“It has become increasingly obvious to the family that the company is facing a number of headwinds,” he said. Oriflame, whose markets currently include Turkey, the former Soviet Union and Latin America, now “needs to undertake a re-positioning in key geographies” and “achieving this re-positioning has challenges in the public market.”

In an interview after the announcement was made this morning, the chairman said the plan is to cut the number of products Oriflame offers and focus on corners of the market where margins are higher.

Analysts monitoring Oriflame shares had been largely positive. Of the six tracked by Bloomberg, three were advising clients to buy, two said hold on to existing stock and only one recommended that investors should sell. On average, analysts expected Oriflame shares to trade at about 195 kronor 12 months from now, indicating upside potential of about 16%.

Some were considerably more downbeat on the stock. According to regulatory filings, BlackRock this month raised its short interest in Oriflame, bringing it to 4.58%.

--With assistance from Anna Molin and Veronica Ek.

To contact the reporters on this story: Hanna Hoikkala in Stockholm at hhoikkala@bloomberg.net;Niklas Magnusson in Stockholm at nmagnusson1@bloomberg.net

To contact the editor responsible for this story: Tasneem Hanfi Brögger at tbrogger@bloomberg.net

©2019 Bloomberg L.P.