Dec 4, 2020

Ottawa eyes 'pre-loaded stimulus' in Canadians' savings accounts

By Greg Bonnell

Minister Freeland calling on Canadians for ideas on how to 'unlock the pre-loaded stimulus'

As Canadians look to Ottawa to repair an economy ravaged by COVID-19, there’s a growing focus on our savings accounts as a source of potent fiscal stimulus just waiting to be “unleashed.”

Bay Street economists estimate businesses and households are sitting on upwards of $170 billion in excess cash. It’s an eye-popping figure the Trudeau Liberals are taking notice of, with no less than five references in the Fall Economic Statement to “unleashing” that money.

“I do see the cash mountain, in both Canada and the U.S., as a serious source of potential upside to next year’s growth,” Doug Porter, chief economist at BMO Capital Markets, wrote in an email.

“I believe there is a strong case for a powerful comeback next year – if you open it, they will spend.”

While much of the focus of the fiscal update was on supports to get businesses and workers through the immediate challenges of COVID-19, the document did cast an eye to the recovery period with a pledge to commit up to $100 billion in stimulus over three years.

Of course, that additional stimulus, when it comes, would only add to Canada’s mounting debt pile – which is set to push past $1.2 trillion as the country goes deep into deficit spending battling the pandemic.

So it’s easy to see why our savings accounts are creating such a stir.

- 4 smart ways to invest all that excess cash

- Feds keep spending taps open, put off big-ticket promises

- Canadians sitting on largest cash hoard ever recorded: CIBC

READ MORE

Finance Minister Chrystia Freeland called that cash the “Canadian economy’s pre-loaded stimulus” in her fiscal update speech to the House of Commons. And the update itself makes clear that “unleashing these savings will be a key element of the government’s recovery plan.”

Some of the country’s top economists agree

“This money will be utilized aggressively, mainly by households,” Benjamin Tal, deputy chief economist at CIBC, said in an email.

“I believe that a large share of this excess cash is held by high-income individuals and they are really looking forward to spending it, mainly on services.”

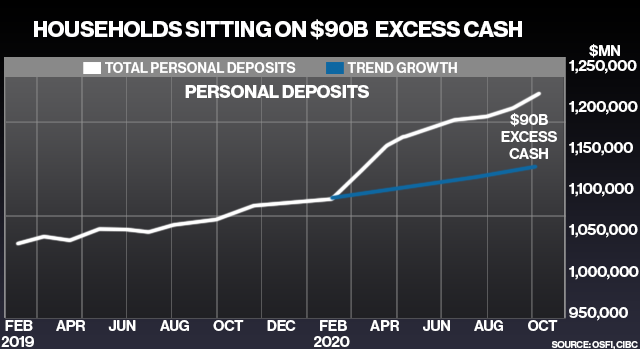

In a report published last month, CIBC put the excess savings of households at $90 billion while businesses are thought to be sitting on some $80 billion. Businesses, said Tal, will put some of that cash toward repaying loans “and the rest will be spent more slowly.”

“That’s where government can be effective by simplifying and reducing red tape,” he said.

While Ottawa is promising more detail on its stimulus plan in the spring budget, the fiscal update did indicate the federal government would “prioritize investments that act fast and help unleash some of the additional savings.”

When it comes to households, it’s questionable just how much prodding they’ll need from Ottawa to spend – if any.

“Just distribute the vaccine and get out of the way,” said Tal. “There is enough motivation to spend, no need for help.”

Porter also expects “spending to come back strongly on its own” once the country is past the worst of the pandemic.

“If we attempt to force-feed spending now, we risk channeling even more spending into areas that are already hot, and won’t benefit the sectors that are in the most dire situation,” Porter said.

“If it turns out that as things re-open and consumers are still reluctant, then it may make sense for policy to shift.”