As the Omicron variant delays a return to the office for workers in Canada, one Bay Street analyst is downgrading Dream Office REIT as rising vacancies hurt the company's operating performance.

National Bank Financial Analyst Matt Kornack told clients in a report on Monday that he lowered his rating on Dream Office REIT to "sector perform" from "outperform," while slightly raising his 12-month target price on the company's shares to $27 from $26.

That downgrade comes as Kornack sees the delayed return to work exacerbating an already muted leasing environment for the Toronto-based commercial landlord.

"We upgraded Dream Office in June 2020 on the belief that the worst of the pandemic was over and people would naturally gravitate back to physical workspaces," said Kornack.

"We still believe that the latter will happen in time but a year and a half later during the fifth wave of COVID and back to mandated stay-at-home orders, our patience is waning and operating performance has deteriorated. The longer this lasts, the deeper the hole from which to recover combined with more competition from new supply."

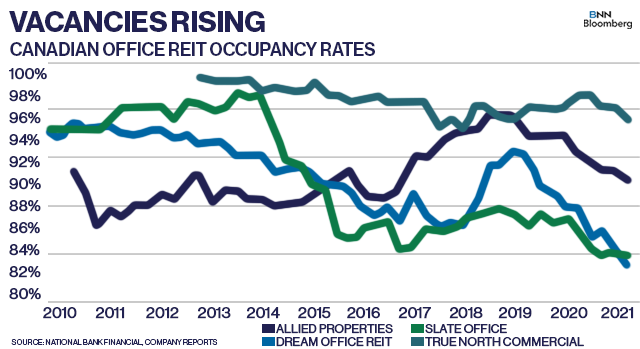

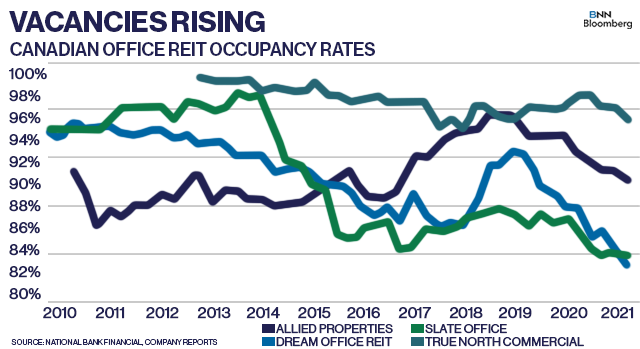

Kornack notes that Dream Office's leasing supply has eroded since mid-2020 to 83 per cent of the company's portfolio in the third quarter of 2021 from 88 per cent. More vacant space has opened up in its Toronto locations with occupancy now falling to 88 per cent in the Q3 from 97 per cent in mid-2020, Kornack said.

"The trend at current makes us think a positive inflection is a ways off and in the interim, equity investors will have more opportunistic places to deploy capital," he said.