Mar 31, 2023

Outages Pose Risk to Upward Phase of South Africa Business Cycle

, Bloomberg News

(Bloomberg) -- South Africa’s escalating energy crisis and logistics-network constraints mean an upward phase in the country’s business cycle is likely to be short lived.

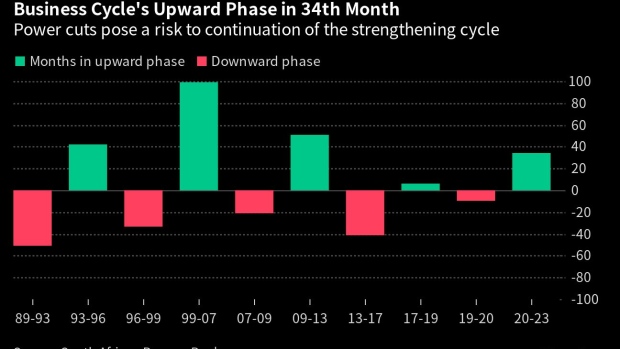

The economy entered the 34th month of a strengthening cycle in March, data in the South African Reserve Bank’s Quarterly Bulletin published Friday show. That’s as it started to recover from the harshest phase of the nation’s coronavirus lockdown, which included restrictions on all but essential activity and mobility.

Africa’s most industrialized economy rebounded from the pandemic-induced contraction, growing at the fastest pace in 14 years in 2021. Since then, supply-side constraints, including those stemming from the failure of state-owned companies Eskom Holdings SOC Ltd. and Transnet SOC Ltd. to respectively generate enough power to meet demand and effectively manage the nation’s ports and rail network have been driving up costs and eroding economic growth prospects.

Gross domestic product growth slowed to 2% in 2022, and the likes of the central bank, the International Monetary Fund and Fitch Ratings expect the economy to barely grow this year. Much of the slowdown is due to the supply-side constraints, which pose a risk to the continuation of the upswing in the business cycle, the South African Reserve Bank said in an emailed response to questions.

The length of current upward phase surpasses that recorded from May 2017 to June 2019, when South Africa benefited from strong global economic growth, higher commodity prices and renewed optimism after Cyril Ramaphosa became president. It was identified after the central bank undertook work to find turning points in the cycle.

©2023 Bloomberg L.P.