Mar 24, 2023

Over Half of Swiss Disapprove of UBS’s Credit Suisse Takeover

, Bloomberg News

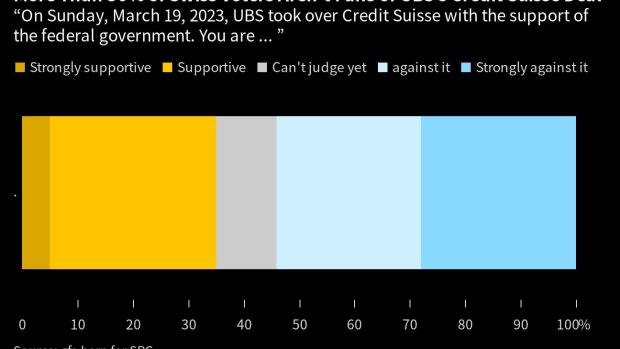

(Bloomberg) -- More than half of the Swiss population don’t approve of UBS Group AG’s government-brokered takeover of troubled rival Credit Suisse Group AG, according to a recent poll.

A total of 54% were against or strongly against the controversial deal, the GFS poll run between March 21 and March 23 shows. Just 1 in 20 Swiss, or 5% polled, were strongly supportive of the decision and another 30% somewhat supportive of the takeover, which was negotiated last weekend.

The deal, brokered by the Swiss government and central bank to avoid triggering a broader financial crisis has nonetheless been widely criticized, and prompted the threat of multiple lawsuits and dented Switzerland’s reputation for financial stability. The emergency ordinances the Swiss government invoked to ensure the takeover happened must still be approved by Swiss parliament, which has convened an extraordinary assembly in April to do so.

The deal earned greater support in French-speaking Switzerland where 41% were somewhat or strongly in favor of the deal, whereas among the larger German-speaking population, support partly or fully in favor was just 33%.

Two alternatives were put to those polled: a temporary nationalization of Credit Suisse by the state or a controlled bankruptcy wind-down. Some 40% argued a temporary takeover would’ve been better, and just 23% were in favor of the bankruptcy option.

Read More: UBS to Buy Credit Suisse in $3 Billion Deal to Fight Crisis

--With assistance from Zoe Schneeweiss.

©2023 Bloomberg L.P.