Apr 20, 2021

P&G Plans to Raise Prices as Inflation Hits Grocery Shelves

, Bloomberg News

(Bloomberg) -- Procter & Gamble Co. is raising the prices of some consumer products as the household-goods behemoth grapples with higher commodity costs.

With manufacturing expenses climbing for products like diapers, the owner of the Pampers and Always brands has started implementing price hikes in the baby care, feminine care and adult incontinence categories. The increases, to take effect by September, could be in the mid- to high-single digit percentages, the company said Tuesday as it reported third-quarter earnings.

P&G will make the adjustments “where it’s necessary” to offset certain costs, Chief Operating Officer Jon Moeller said in an interview. The company also plans to focus on product innovation “so that we actually improve consumer value as we implement that pricing.”

Moeller cited higher pulp and oil-related prices as a factor, and said that across the board, “this is one of the bigger increases in commodity costs we’ve seen.”

The moves, which affect retailers and may be passed on to customers, underscore the growing consumer impact of inflationary pressures as commodity prices increase and shipping challenges drive up costs for manufacturers. Coca-Cola Co. said this week that it expects prices to rise globally beginning this quarter, while Kimberly-Clark Corp. has already started notifying customers of similar plans for North America.

P&G, whose lineup of brands also includes Charmin and Tide, is trying to navigate the waning stages of the pandemic, which had given it a boost as quarantined consumers stocked up on toilet paper and other household supplies. Wall Street is watching for signs of slowing demand as vaccinations increase and consumer behavior begins to normalize.

Its shares fell 1.3% as of 9:39 a.m. in New York trading. P&G had slipped 1.8% this year through Monday’s close, trailing an 11% gain in the S&P 500 Index.

Sales for the quarter ended March 31 rose 5%, P&G said, or 4% on an organic basis, which excludes the impact of acquisitions or currency. Revenue of $18.1 billion surpassed the average of analyst estimates. Core earnings of $1.26 a share, adjusted to exclude some items, also topped expectations, even as higher commodity costs weighed on profit margins.

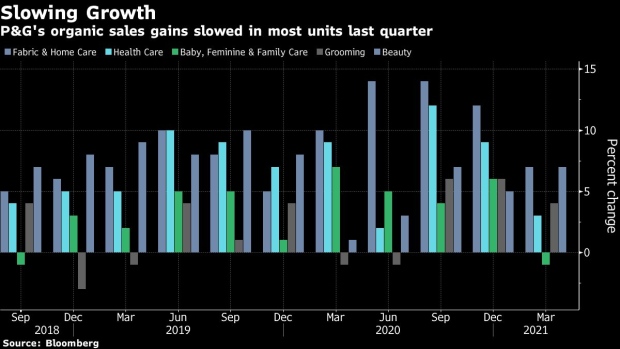

Uneven Gains

The results were uneven, though. Organic growth in the beauty and baby, feminine and family care units missed expectations, while the grooming and fabric and home care operations beat.

“Even if we see some reduction in the tailwinds that we’ve enjoyed in some businesses,” there will be gains elsewhere, Moeller said. He said the increased focus on health and hygiene should continue to bode well for the company’s cleaning-supplies business.

The results for the past quarter were “solid,” Stifel analyst Mark Astrachan said in a note. Still, by holding the full-year outlook steady even after beating expectations in the third quarter, that implies “weakness relative to consensus” for fourth-quarter earnings, he said.

While P&G maintained its sales and earnings forecasts for the full fiscal year, the company said it now expects after-tax commodity costs to be about $125 million higher than in fiscal 2020. The outlook also includes a $200 million impact from higher freight expenses.

Moeller doesn’t expect P&G to be hurt disproportionately, because commodity prices tend to “affect everyone, so it generally leads to a more conducive pricing environment.”

(Updates stock trading, adds COO quote from analyst call and analyst commentary.)

©2021 Bloomberg L.P.