Oct 27, 2020

‘Pain Threshold’ Nears for Lira as Erdogan Dials Up Rhetoric

, Bloomberg News

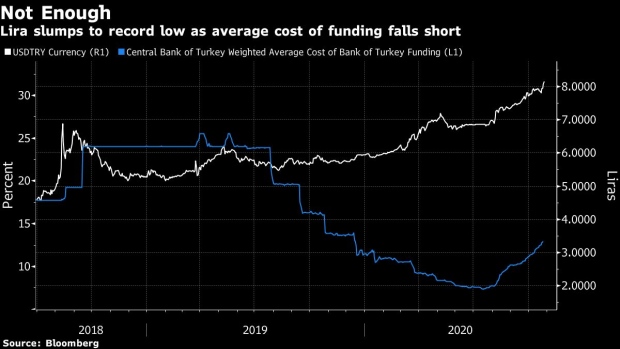

(Bloomberg) -- The Turkish lira sank for a fourth day even as state lenders stepped in to prop up a currency battered by central bank policy surprises and confrontational rhetoric from the nation’s president.

The lira bucked gains seen by other emerging-market currencies, weakening as much as 1.4% to a record low against the U.S. dollar on Tuesday. The Turkish central bank’s decision last week to hold interest rates sparked the rout and has prompted calls for an unscheduled policy hike.

The “pain threshold” is probably near, said Henrik Gullberg, a London-based macro strategist at Coex Partners Limited. “Selloffs in the lira, which followed periods of some stability, have been of a magnitude of around 30-35% before the central bank stepped in with emergency hikes. That’s roughly where we are now.”

The lira is down 27% this year and has posted the longest run of weekly declines since 1999.

The retreat also coincides with President Recep Tayyip Erdogan’s broadside against France’s Emmanuel Macron as well as a challenge to Washington over Turkey’s decision to test its S-400 missile defense system supplied by Russia. On top of that, U.S. elections and a surge in new Covid-19 cases are curbing appetite for riskier assets.

State-run lenders have sold more than $1 billion to support the currency so far this week, according to two people with knowledge of the matter who asked not to be identified because the details aren’t public. State banks don’t comment on interventions in the foreign-exchange market.

Late Monday, Turkey’s banking regulator, BDDK, took a further step to slow lending and support the lira. Banks will be able to include foreign-currency loans extended to other local lenders for one year when calculating their asset ratio, making it easier for them to meet the requirement, it said.

While the move helped lift banking stocks, it fell short of providing relief to the currency, which traded down 1.2% at 8.1877 per dollar as of 5:25 p.m. in Istanbul.

‘Geopolitical Noise’

The biggest concern for investors remains the central bank’s reluctance to deliver a decisive interest-rate increase that would confirm its commitment to stemming the lira’s depreciation.

“The central bank needs a big, sudden tightening to halt the lira slide,” said Gabriele Foa, a London-based money manager at Algebris U.K. Ltd. “Using reserves is not an option anymore because they simply don’t have enough.”

While monetary issues are the main driver for the lira, “geopolitical noise” isn’t helping, he said. “Ankara’s tone has been recently confrontational on a number of issues.”

On Sunday, Erdogan challenged the U.S. to sanction the country over its purchase of Russian S-400 missile defense systems. He also stepped up criticism of Europe’s treatment of Muslims, repeating an attack on his French counterpart by suggesting he needed “mental treatment,” and urging on Turkish people to boycott French goods on Monday.

©2020 Bloomberg L.P.