May 27, 2022

Pakistan Faces $6.4 Billion in Foreign Debt as IMF Talks Drag On

, Bloomberg News

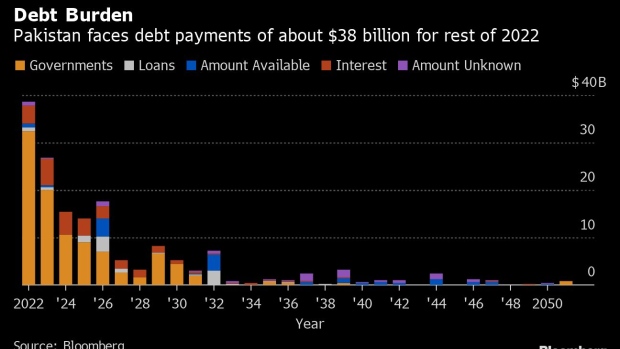

(Bloomberg) -- Pakistan faces $6.4 billion in dollar debt due over the next three years as Prime Minister Shehbaz Sharif’s new government is trying to meet bailout terms set by the International Monetary Fund.

The country, under pressure to keep its economy afloat and avert a sovereign default, needs about $3.16 billion to pay dollar bonds and loans this year, $1.52 billion next year and $1.71 billion in 2024, according to data compiled by Bloomberg.

With a $45 billion trade deficit in the current fiscal year to June and foreign-exchange reserves at $10.1 billion, or less than two months of imports, Pakistan faces the prospect of default for the second time in its history.

The external debt due in the coming fiscal year starting July is estimated to be bigger by Fitch Ratings. The ratings firm includes bilateral obligations of $3 billion owed to Saudi Arabia in time deposits and $4 billion from China’s State Administration of Foreign Exchange, said Jeremy Zook, a Fitch analyst.

In a move aimed at meeting a key bailout condition set by the IMF to unlock the remaining $3 billion from a loan program, the government raised the cost of gasoline and diesel by 30 rupees a liter effective Friday.

“The resumption of its IMF program is necessary to avoid a balance of payments crisis,” said Patrick Curran, senior economist at Tellimer Ltd., a London-based emerging markets investment research firm.

Tellimer has a buy recommendation on Pakistan’s 2031 dollar bonds, which are trading at mid-60 cents per dollar and yields 15%, as “risks are now largely priced in,” Curran said.

©2022 Bloomberg L.P.