Jun 1, 2023

Pakistan Keeps Asia’s Fastest Inflation Title for Second Month

, Bloomberg News

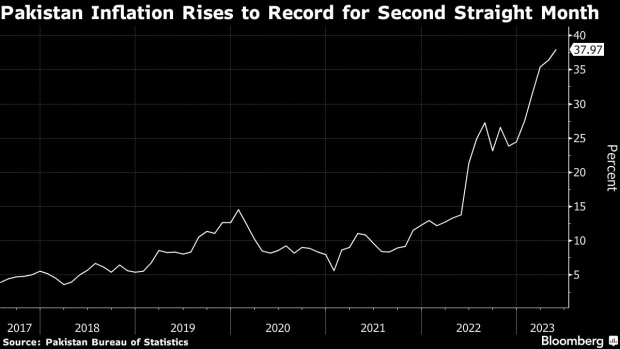

(Bloomberg) -- Pakistan’s inflation has hit another record high, making it Asia’s fastest for a second month, just days before the national budget is due to be unveiled by a government facing unprecedented economic challenges.

Consumer prices rose 37.97% in May from a year earlier, according to data released by the Pakistan Bureau of Statistics Thursday. That compares with a median estimate for a 37.6% gain in a Bloomberg survey and a 36.4% increase in April.

It marks the fourth consecutive month that Pakistan’s inflation rate has been over 30% year-on-year, largely due to surging food and fuel prices, and adds to pressure on the central bank after it hiked the key interest rate to a historic high last month.

The acceleration has picked up pace since last June when inflation first climbed over 20%, fueled in part by the government’s move to raise taxes and energy prices in a bid to revive a stalled $6.7 billion International Monetary Fund bailout. A slow recovery from last year’s floods has led to shortages of essential crops, pushing up food prices. The Pakistani rupee has declined some 30% against the dollar over the past year, making imported goods more expensive.

Price pressure is just one of the many issues the government will be seeking to address when it presents its budget for the financial year 2024, which is expected to take place on June 9. It’s pledged to keep reforming the economy ahead of general elections due in October, even as it confronts a political crisis that’s seen opposition leader Imran Khan push for polls before then.

Transport prices climbed 52.9% while food inflation quickened 48.7% in May from a year earlier, the data showed. Clothing and footwear prices gained 22.5% and housing, water and electricity costs rose 20.5%.

Prices are likely to cool in June and July due to the high base-effect of last year, said Fahad Rauf, head of research at Ismail Iqbal Securities. “The type of taxes in the next budget will determine the extent of slowness. A low inflationary budget can lead to as low as 25% inflation.”

The next monetary policy review is due on June 12, when the State Bank of Pakistan will decide whether to take action after increasing its benchmark interest rate to 21% in April, the highest since records began. Bloomberg Economics sees it avoiding tightening policy further for now.

What’s clear is that Pakistan’s consumers are facing spiraling prices for a whole host of goods, putting items such as basic home appliances out of the reach for many. One shop in Karachi’s main market is used to selling 20 to 45 air conditioners in a day, now it struggles to sell 10.

“Decent families that come in cars are going back empty handed after checking prices,” said Rizwan Hassan, a salesman in Karachi’s main market for 16 years. “Prices have more than doubled. How can they afford it.”

(Updates with details in sixth paragraph)

©2023 Bloomberg L.P.