Jun 11, 2021

Pakistan Proposes Budget to Boost Growth as Pandemic Recedes

, Bloomberg News

(Bloomberg) -- Pakistan plans to spend its way out of the pandemic-induced slump, with a new budget that seeks to put more money in the hands of people and boost economic activity.

The federal government proposes to raise salaries of government employees by 10% in the year beginning July 1, Finance Minister Shaukat Tarin said in his budget speech in Islamabad on Friday. Taxes on some equity as well as banking transactions will be pared or abolished, he said.

The giveaways notwithstanding, Tarin targets to narrow the budget gap to 6.3% of gross domestic product from 7.1% of GDP this year, less than 1 to 1.5 percentage points the minister estimated last month.

He aims to achieve that by ramping up revenue collection by 25% to 7.9 trillion rupees ($51 billion) in the next fiscal year. Of that, 5.8 trillion rupees would be mopped up from taxes, compared with 4.7 trillion rupees this year, he said.

The budget is an opportunity for Tarin to strengthen Pakistan’s fragile economy, which is currently under a $6 billion bailout program from the International Monetary Fund. A drop in coronavirus cases is allowing the nation to reopen slowly, paving the way for demand to kick in.

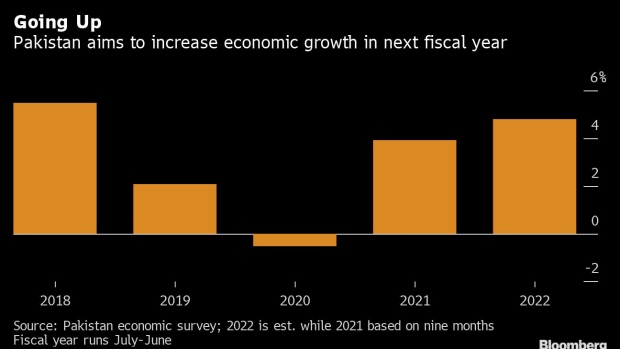

The South Asian nation forecast a GDP growth of 4.8% for the next fiscal year, compared with an estimated 3.9% this year. The nation, which recorded a rare GDP contraction last year, targets to achieve a growth of 7% in the next two years, Tarin said.

“It is a spending-led confidence building budget exercise,” said Mohammed Sohail, chief executive officer of Topline Securities Pakistan. “The biggest challenge will be to deal with IMF and rising commodity prices.”

Here are some key proposals from the budget:

- Total spending for next fiscal year pegged at 8.4 trillion rupees vs 7.1 trillion rupees last year

- As much as 900 billion rupees will be earmarked for development spending by the federal government , compared with 650 billion rupees this year

Proposes to reduce capital gains tax on stocks to 12.5% from 15%

- To abolish withholding tax on equity trading as well as banking transactions

- Proposes to reduce sales tax on locally-made cars of 850cc power

- To reduce tax on completely knocked-down units of imported electric vehicles

- Expects to raise 560 billion rupees through global bonds including Eurobond and Sukuk

- Proposes to provide loans on concession to farmers and small businesses

©2021 Bloomberg L.P.