Nov 13, 2019

Palm Imports by India Seen Sliding From One-Year High on Prices

, Bloomberg News

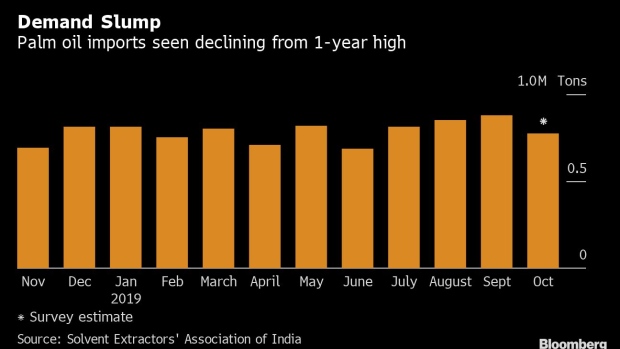

(Bloomberg) -- India’s palm oil imports probably declined from a one-year high in October as traders and refiners trimmed buying after higher global prices made overseas supplies more expensive.

Shipments dropped about 12% from a month earlier to 775,000 tons, according to the median of five estimates in a Bloomberg survey of processors, brokers and analysts. That’s the lowest since June. Imports rose to 879,947 tons in September, the highest since September 2018. The Solvent Extractors’ Association of India may release its data this week.

The first decline in three months of growing purchases by India, the world’s biggest importer, may boost inventories in top producers Indonesia and Malaysia. It could also curb a rally in palm oil futures, which surged 16% in October for the best monthly gain since September 2015. After tumbling to a four-year low in July, futures entered a bull market last month, supported by lower stockpiles, strong exports and weaker production.

“There is a disparity in prices and that will reduce imports by India this month as well,” said G. G. Patel, managing partner of GGN Research, an agricultural research company. Palm purchases may total 625,000 tons this month, he said.

Imported crude palm oil is about 1,200 rupees ($17) a ton more expensive than local supplies, while the refined variety from overseas is about 1,000 rupees a ton costlier, Patel said.

Soybean oil purchases, mostly from the U.S., Brazil and Argentina, climbed 34% from a month earlier to 332,000 tons, while sunflower oil imports rose 34% to 170,000 tons, the survey showed. Total vegetable oil imports were little changed at 1.3 million tons, according to the survey.

NOTE: Figures in metric tons

To contact the reporter on this story: Pratik Parija in New Delhi at pparija@bloomberg.net

To contact the editors responsible for this story: Anna Kitanaka at akitanaka@bloomberg.net, Atul Prakash

©2019 Bloomberg L.P.