Apr 22, 2021

Pandemic-battered workers change retirement plans — to work longer

, Bloomberg News

The pandemic has had a tremendous impact on our business: Chartwell Retirement Residences' CEO

Many workers who were hurt by the pandemic are saying they’ll now retire later than planned.

Nearly two in five workers were furloughed or laid off — or had their pay cut or hours reduced — since February 2020, according to the latest annual survey about retirement confidence by the Employee Benefits Research Institute and Greenwald Research. Of those, about a quarter say they now think they won’t be able to retire until later than planned, according to the survey released Thursday.

Even workers who hadn’t had a pay cut are revisiting the decision, with 22 per cent tweaking the date, most aiming for a later exit.

The figures give a glimpse of the long-term impact of the pandemic on people’s working lives, even as the U.S. economy stages a comeback. There are still 8 million fewer jobs than in February 2020, and the unemployment rate of 6 per cent is still nearly twice as high as before the pandemic.

The survey, now in its 31st year, has consistently found that life often doesn’t cooperate with our plans. The median age at which workers want to retire is 65. The median retirement age reported by retirees, however, is 62.

Want to keep working into your 70s? You probably won’t keep it up, data show. Twenty-six percent of the 1,507 workers surveyed said that was their plan — but among the 1,510 retirees surveyed just 6 per cent worked into their 70s or beyond.

More than a third of respondents who said they’d retired earlier than planned said a hardship like a health problem or disability was the reason. A recent survey by the Census Bureau found that more than 3.1 million Americans age 55 or older have plans to apply for Social Security benefits earlier than planned because of the pandemic.

Others said they retired earlier because they could afford to.

Overall confidence about being able to retire comfortably is actually up 3 percentage points from last year, with 72 per cent of workers confident they can live comfortably in retirement, and 29 per cent very confident. Fifteen percent of workers said their confidence had increased in the past year, and confidence among retirees was unchanged by the pandemic, at 76 per cent, where it stood in the 2020 survey.

“With this survey, one thing I’m often struck by — and maybe more so this year — is the concept of resilience, particularly among retirees,” said Lisa Greenwald, chief executive officer of Greenwald Research and co-author of the report. “There’s been talk for decades about a retirement crisis, yet retirees are saying they’re okay, that their lifestyle is better than expected, that their expenses are as expected.”

But while retirees are confident, they are reluctant to spend down assets. When the survey asked retirees what the priorities were for that savings beyond necessities, about a third said they were holding money in reserve for medical and long-term care costs. “That is the big unknown,” said Greenwald. “It’s also a little contradictory to their tremendous confidence in Medicare, which has reached an all-time high.”

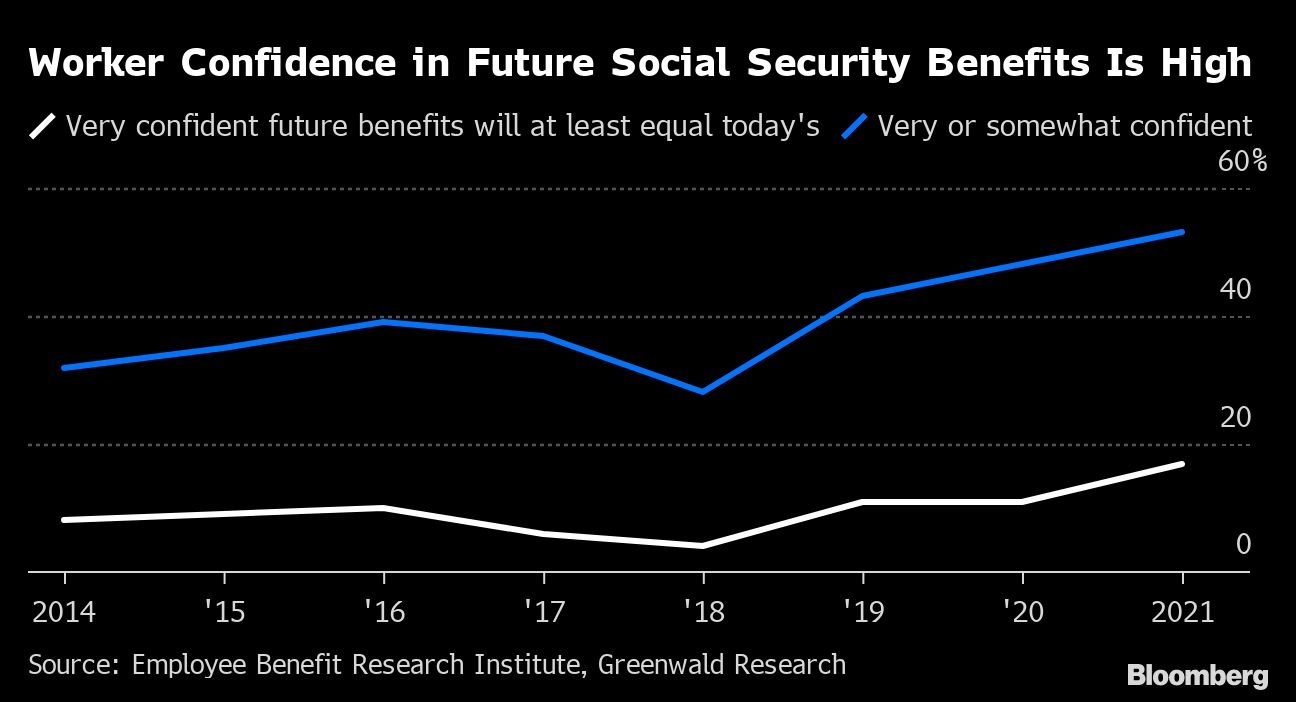

Confidence in Social Security also reached an all-time high in this year’s survey. About three-quarters of retirees and 53 per cent of workers expect Social Security benefits to stay at least at current levels. Social Security was cited as a major source of income for 60 per cent of retirees surveyed.

“For Social Security, the past year may have been an encouraging one for retirees, despite the pandemic and its economic impact,” Greenwald said. “Social Security payments continued, Social Security recipients got stimulus payments, and the fact that we’re seeing confidence in Social Security at relatively high levels may have something to do with Social Security itself surviving a bad year.”