Mar 9, 2020

Triple-leveraged oil fund among niche ETFs that are plunging

, Bloomberg News

Oil market carnage may signal 'the start of the end' for OPEC: Trader

Distress reigns in corners of the market for exchange-traded products as the spreading coronavirus and all-out oil price war upend assets around the world.

U.S. stocks plunged, crude slid the most since 1991 and Treasury yields plumbed record lows. Credit markets torpedoed and the dollar slumped. And now, the pithy slogan “there’s an ETF for that” means there’s a product getting hammered in areas of the markets most under duress.

Here’s where the pain is most acute:

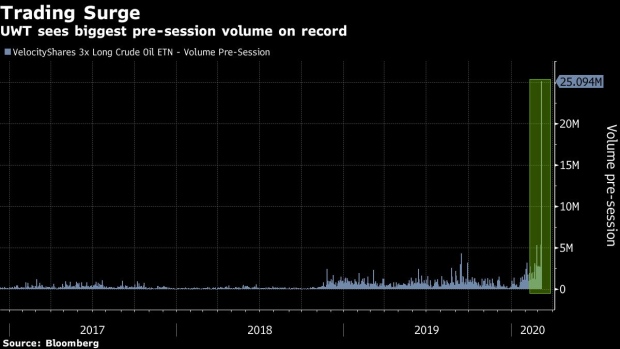

Oil

- VelocityShares 3x Long Crude Oil ETN, or UWT, plunged 71 per cent, extending this year’s losses to 92 per cent. Volume in pre-session trading soared to a record high. Based on Friday’s closing price, the net indicative value of the notes would have to fall 75 per cent to below US$0.975 to constitute a so-called “trigger event,” putting its future in jeopardy.

- ProShares UltraPro 3X Crude Oil ETF, or OILU, also saw trading surge to an all-time high before the market opened. The US$131 million fund tumbled 70 per cent to a record low, extending its 2020 plunge to 91 per cent.

- The US$107 million Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3X Shares ETF, or GUSH, sank 81 per cent, the most since it was launched in June 2015.

- The US$8.8 billion Energy Select Sector SPDR Fund, the largest ETF tracking the industry, plunged almost 20 per cent Monday. XLE posted its biggest decline since it started trading in 1998.

Treasury Bears

- The US$451 million ProShares UltraShort 20+ Year Treasury fund, or TBT, plunged to the lowest since it was launched during the global financial crisis.

- The Chicago Board Options Exchange delisted the iPath US Treasury Long Bond Bear ETN, DLBS, Barclays Plc said in a statement. The US$931,000 ETN closed below US$3 on Feb. 28.

Banks

- The US$1.3 billion SPDR S&P Regional Banking ETF, or KRE, extended its three-day plunge to 23 per cent. Its Monday loss was the biggest since December 2008.

- The US$267 million iShares U.S. Regional Banks ETF, or IAT, slid 15 per cent -- its largest rout since January 2009.

- One industry behemoth -- the US$18.2 billion Financial Select Sector SPDR Fund (XLF) -- was down 11 per cent on Monday. The ETF has seen net outflows of US$2.16 billion so far in 2020.

Emerging Markets

- The US$25.2 billion iShares MSCI Emerging Markets ETF, or EEM, extended its three-day plunge to about 11 per cent. That’s the worst drop for such a span since 2011.

Pets, Travel and Pot

- The ProShares Pet Care ETF, or PAWZ, extended a three-day rout to about 9 per cent -- the biggest since the fund was launched in November 2018.

- The ETFMG Travel Tech ETF, or AWAY, extended a sell-off since it began trading last month to 29 per cent.

- The US$567 million ETFMG Alternative Harvest ETF, or MJ, slumped 10 per cent Monday to its lowest price ever.

- ETFMG Prime Cyber Security ETF, or HACK, had its biggest decline since it began trading in November 2014.