Jan 31, 2023

PayPal to cut 2,000 jobs in push to trim costs

, Bloomberg News

Tech layoffs foreshadowing job market weakness down the road: Investment strategist Jake Jolly

PayPal Holdings Inc. said it will cut 2,000 staffers as it contends with a macroeconomic slowdown that’s weighed on the firm’s business in recent quarters.

The cuts, which will affect about 7 per cent of employees, will take place in the coming weeks, Chief Executive Officer Dan Schulman told employees in a memo.

“While we have made substantial progress in right-sizing our cost structure, and focused our resources on our core strategic priorities, we have more work to do,” Schulman said.

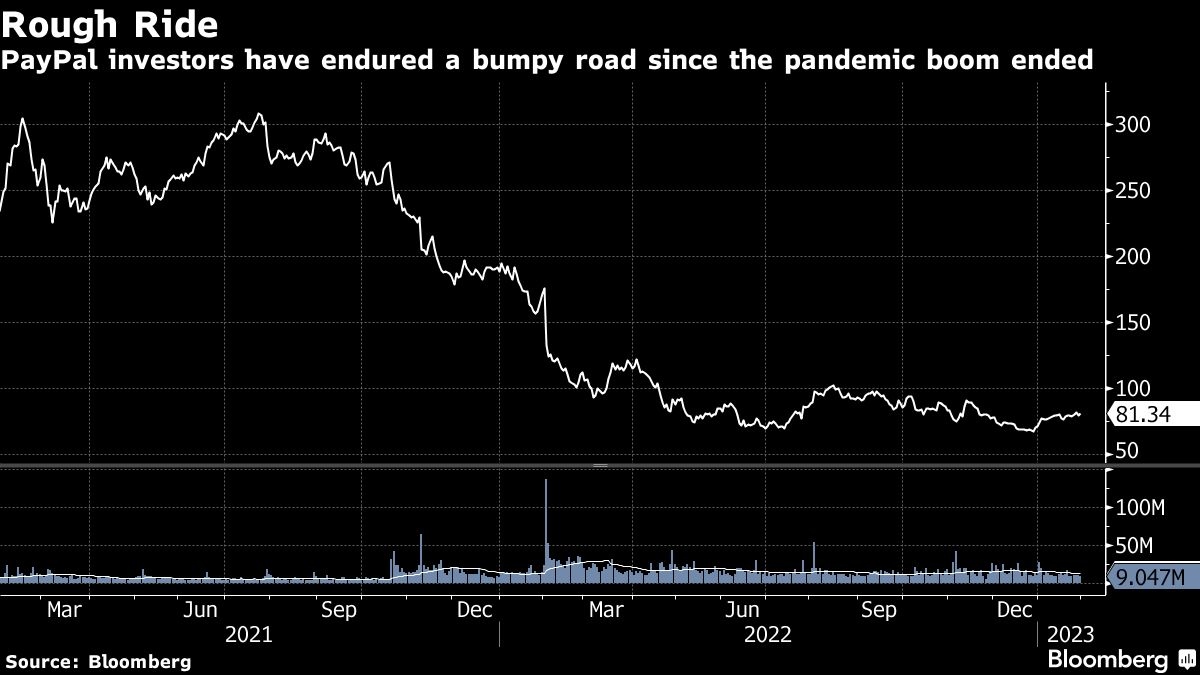

PayPal’s stock has been battered by the slowdown in growth in payments volume on its platform after the pandemic began to recede. In response, the company has vowed to reduce expenses — including through job cuts and the shuttering of offices across the country.

Those moves should have helped the company notch US$900 million in savings last year and at least an additional US$1.3 billion in 2023, Schulman has said. The 65-year-old CEO has been vocal about his plans to improve his firm’s operating leverage — or the ability to grow revenue faster than expenses.

PayPal shares jumped 1.9 per cent to US$81.14 at 3:55 p.m. in New York. The stock has climbed 14 per cent this year, outpacing the 9 per cent advance of the S&P 500 Information Technology Index.

PayPal — like many other so-called pandemic darlings — saw headcount swell when the virus forced governments around the world to issue lockdown orders, spurring consumers to do more shopping online. Now, as those orders have lifted and supply chains remain under pressure, consumers have returned to in store shopping in droves.

PayPal is expected to report that payments volume on its many platforms climbed to US$1.4 trillion last year, according to analyst estimates compiled by Bloomberg. While that’s a 9.6 per cent increase from a year earlier, that would still mark the lowest level of growth in the firm’s history as a public company, the data show.

“Over the past year, we made significant progress in strengthening and reshaping our company to address the challenging macro-economic environment while continuing to invest to meet our customers’ needs,” Schulman said. “We must continue to change as our world, our customers, and our competitive landscape evolve.”