(Bloomberg) -- China’s central bank pledged to use more monetary policy tools to spur the economy and ease credit stress as signs of a property market slump worsen.

Chinese sovereign bonds are poised to rally on the measures as fallout from the real estate sector puts pressure on Xi Jinping’s government to do more to insulate stronger developers and revive growth. Shinsun Holdings Group Co. became the latest developer to be downgraded.

Dollar bonds of some higher-rated developers rebounded Tuesday after the previous day’s turmoil. A gauge of property stocks also rose, snapping four days of declines.

Key Developments:

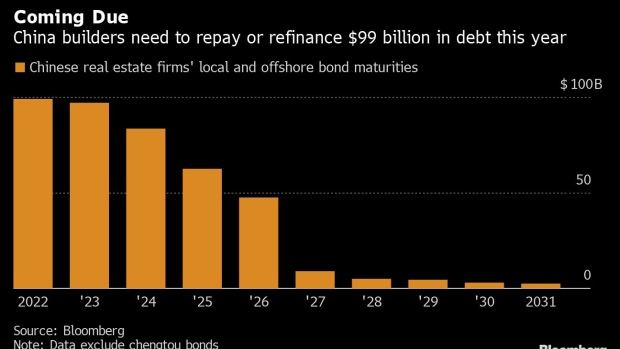

- China’s Spreading Property Debt Crisis Pressures Xi to Ease

- CHINA REACT: PBOC Signals Steady Property, Flexible Yuan

- Why Hidden Debt Is a Big Problem for China Developers: QuickTake

- Chinese Builder Agile Group Downgraded on Liquidity Concerns

- Property Sector Contraction in China Worsens in Blow to Economy

- China Developers Rise on Pudong Bank’s Plans to Fund M&A Loans

- Country Garden Dollar Bonds Jump After Monday’s Record Selloff

PBOC Pledges to Use More Tools, Avoid Collapse (8 a.m. HK)

China’s central bank pledged to use more monetary policy tools to spur the economy and ease credit stress as signs of a property market slump worsen.

The People’s Bank of China will “open monetary policy tool box wider, maintain stable overall money supply and avoid a collapse in credit,” Deputy Governor Liu Guoqiang said Tuesday at a briefing in Beijing.

The central bank will roll out more policies to stabilize economic growth, front-load actions and make preemptive moves, he said. It will address common concerns in the market in a timely manner and stay ahead of the market curve, he said.

Sunac Hasn’t Returned Guarantee Funds (7:55 a.m. HK)

A regional unit of Sunac China Holdings Ltd. has yet to return 30 million yuan ($4.7 million) of guarantee funds to Strongteam Decoration that was due Dec. 30, according to an exchange filing from Strongteam.

China Bond Rally Gathers Steam on Easing Bets (7:50 a.m. HK)

China’s sovereign yield curve is poised to bull steepen as the nation’s bonds extend an advance on expectations the central bank will continue cutting official rates while its global peers tighten policy.

Investors are positioning for the People’s Bank of China to lower rates further in the next few months after Monday’s decision to slice 10 basis points off its one-year policy loans -- the first reduction since April 2020 -- and to trim its seven-day reverse repurchase rate.

While the Federal Reserve is shifting its focus to heading off inflation, Chinese authorities are more concerned about propping up growth as they deal with the fallout from a crisis in the property market, weak private consumption and the risk of bigger coronavirus outbreaks. The PBOC is also expected to pump extra liquidity into the banking system before the Spring Festival holiday week starting Jan. 31.

©2022 Bloomberg L.P.