Jun 27, 2022

PBOC to Keep Policy Supportive for China Economy, Governor Says

, Bloomberg News

(Bloomberg) -- The People’s Bank of China pledged to maintain a supportive monetary policy to aid the economy’s recovery from Covid outbreaks and lockdowns and other stresses.

“The monetary policy will continue to be accommodative to support economic recovery in aggregate sense,” Governor Yi Gang said in an interview with state broadcaster China Global Television Network, according to a transcript released by the central bank Monday.

The central bank’s “high priorities” are to maintain stable prices and maximize employment, Yi said. It will also continue to focus on structural policies such as those supporting small businesses and green projects, he said.

China’s “real interest rate is pretty low” after taking inflation into account, Yi said. The inflation outlook is stable, he said, with consumer prices rising 2.1% in May and producer prices increasing 6.4%.

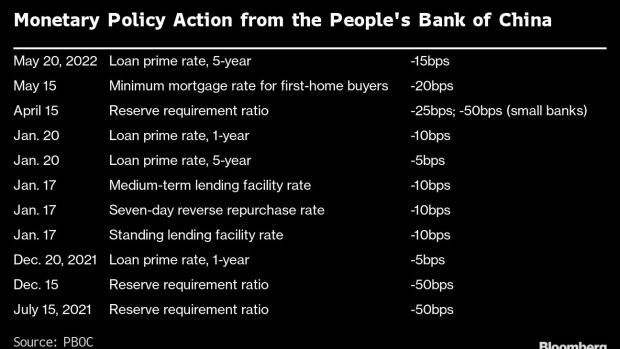

The PBOC has taken a modest approach to easing this year, as weak borrowing demand in the face of Covid lockdowns and the tightening of monetary policy overseas narrowed its policy room. It has refrained from cutting policy interest rates since January.

In response to a question about the yuan’s recent depreciation, he said China has a flexible and market-determined exchange rate system using a basket of currencies as reference. The yuan has strengthened against the US dollar by 25% over the past two decades and even more in real terms, he said.

The central bank has kept the monetary sluice in check and avoided flooding the market with liquidity, PBOC Deputy Governor Chen Yulu said in a briefing last week. Structural monetary policy tools enhance the allocation of loans and at the same time support credit growth, he said, adding that their quantity and scale would be kept at an appropriate level.

©2022 Bloomberg L.P.