Nov 4, 2021

Peloton posts biggest-ever stock wipeout after forecast cut

, Bloomberg News

Stock in the spotlight: Peloton president says treadmill market is 'even bigger' than bikes

Peloton Interactive Inc. shares plummeted the most ever after the company cut its annual revenue forecast by as much as US$1 billion and lowered its projections for subscribers and profit margins.

The fitness company -- best known for its exercise bikes and remote classes -- now expects sales of US$4.4 billion to US$4.8 billion in fiscal 2022, which ends next June. Less than three months ago, it had been predicting revenue of US$5.4 billion. On an earnings call with analysts, Peloton said it underestimated the impact of economic reopenings.

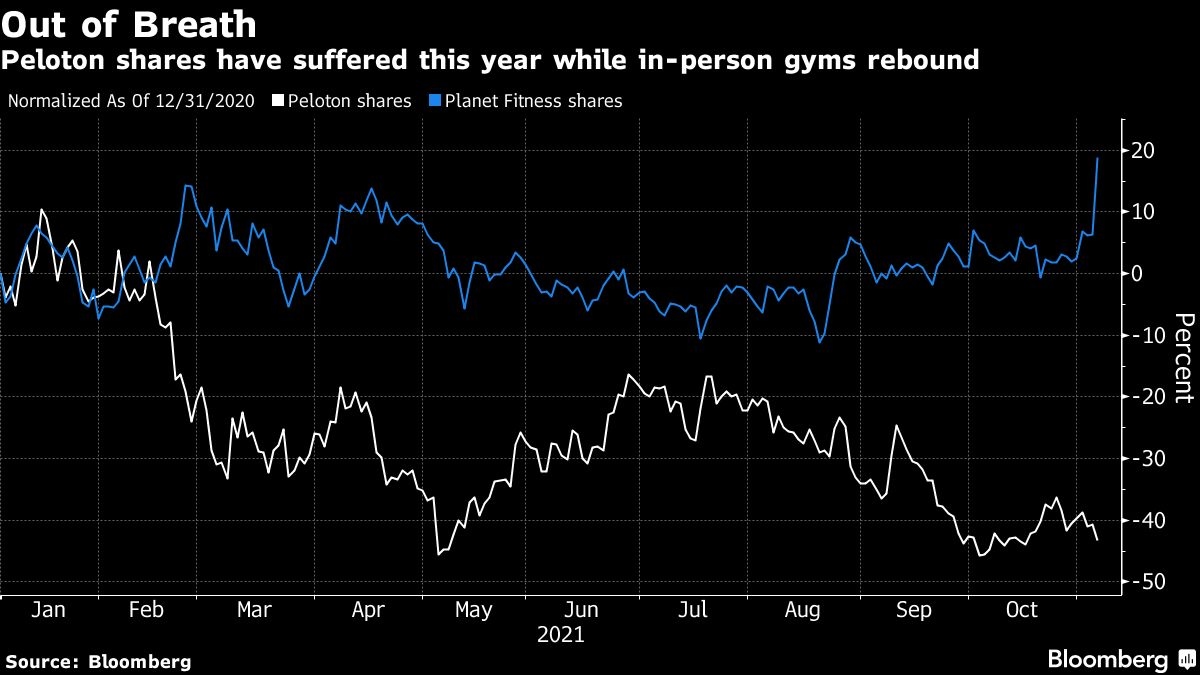

The grim outlook sent the stock down to as low as US$56.39 Friday morning in New York. Several analysts downgraded their ratings. Even before the swoon, Peloton shares were down 43 per cent this year.

“Pandemic poster child in transition mode to the ‘new normal,’” MKM Partners analyst Rohit Kulkarni wrote in a note to investors.

Peloton was a pandemic phenomenon, with customers flocking to home-exercise services during lockdowns. Now people are heading back to the office, school and gyms, sapping demand for the company’s equipment. Supply-chain constraints, as well as the soaring costs of commodities and freight, also are weighing on Peloton.

“We anticipated fiscal 2022 would be a very challenging year to forecast,” management said in a letter to shareholders Thursday. “We will be taking concrete steps to reexamine our expense base and adjust our operating costs.”

At best, Peloton currently expects to have 3.45 million connected fitness subscriptions by the end of the fiscal year. It had previously called for 3.63 million. And gross profit margin will be 32 per cent, compared with an earlier forecast of 34 per cent. All that will add up to a loss of as much as US$475 million, excluding some items.

On Peloton’s earnings call, co-founder and Chief Executive Officer John Foley said the “swift” change in its outlook is “not lost on us” and that visibility into its future performance has become more limited. Executives added that traffic to Peloton’s retail stores and website tapered more than anticipated, but the company saw positive response to price changes and launches internationally, particularly in Australia.

The company cut the price of its original bike by US$400 in August, and that too has hurt profitability -- especially since more shoppers than expected opted for that model over other products.

“A softer-than-anticipated start” to the second fiscal quarter contributed to the company’s decision to rethink its forecast, according to the letter. But Peloton added that its “confidence in and commitment to our strategy is unchanged.”

Like several other companies, Peloton also blamed Apple Inc.’s ad-related privacy changes, which have made it more difficult to target shoppers based on their interests.

Efforts to rein in costs probably won’t begin to show up for a quarter or two, the New York-based company said. Peloton expects to be profitable -- before interest, taxes, depreciation and amortization -- by fiscal 2023.

Revenue rose 6 per cent to US$805.2 million last quarter. That was just above Peloton’s US$800 million forecast, but below the roughly US$809 million anticipated by analysts. The company posted a net loss of US$1.25 a share.

The slim growth came from a 94 per cent increase in revenue from subscriptions, which totaled US$304.1 million. Hardware sales fell 17 per cent to US$501 million in the first quarter.

Peloton expects to report between US$1.1 billion and US$1.2 billion in revenue for in the second fiscal quarter, which ends in December. That would miss Wall Street estimates of US$1.5 billion. It’s projecting 2.8 million to 2.85 million in total fitness subscribers by the end of the period.

On a more upbeat note, the company hinted that it plans to launch new products in the coming weeks and months. Peloton has been working on a rowing machine and a heart-rate monitor that attaches to a wearer’s arm, Bloomberg News has reported.

Peloton previously introduced a line of treadmills, but had to recall both models in May. In August, it brought back the lower-end treadmill, but not the more expensive version, which was linked to a child’s death.

On its call Thursday, Peloton said that it expects the first fiscal quarter to be the “trough” of its results for fiscal 2022 and that inventories are healthy going into the holiday season. But its Precor business -- a division acquired this year that sells workout machines to gyms, hotels and dorms -- has faced supply-chain struggles.

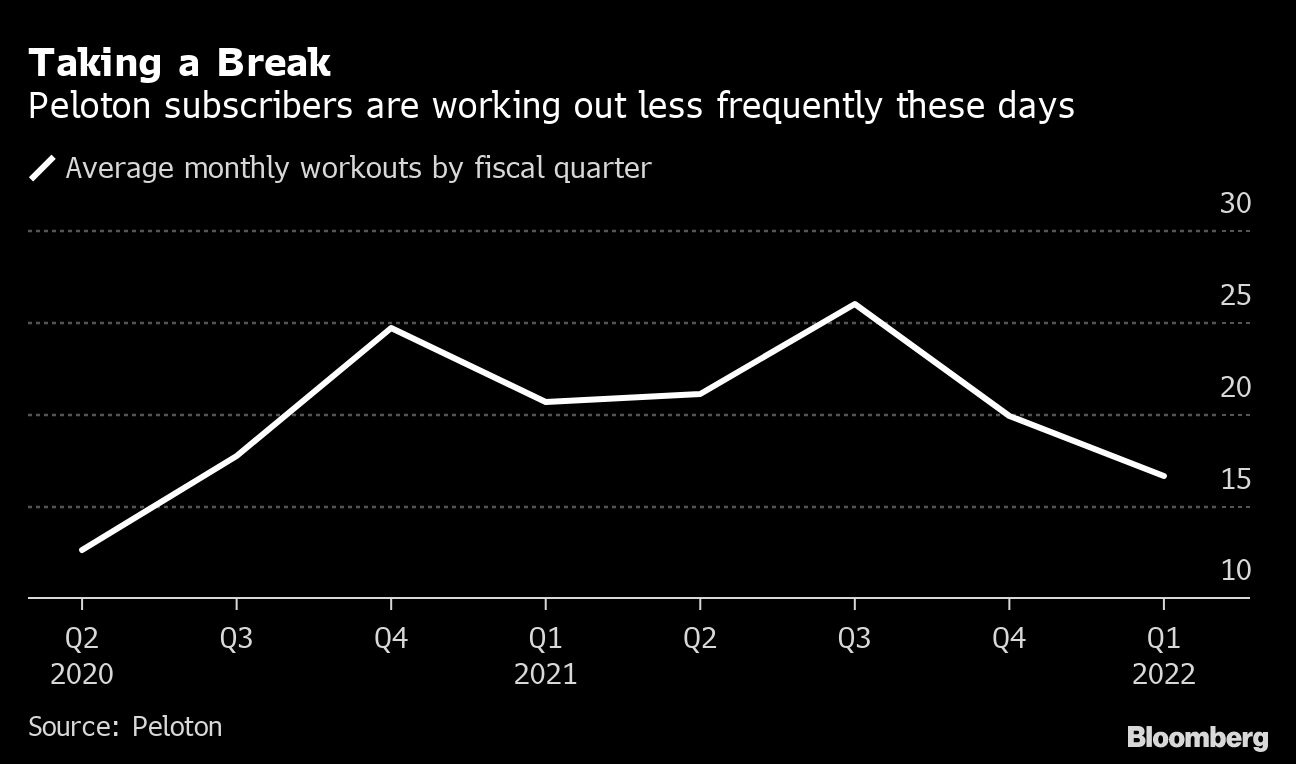

As people continue to return to the office, the average number of monthly workouts fell to 16.6 per subscription from 20.7 a year earlier. In-person gyms, meanwhile, are seeing their fortunes recover. Planet Fitness Inc. jumped to a record high on Thursday after delivering a better-than-anticipated forecast.

Peloton also is trying to shed its upscale image, which may put off many middle-class consumers.

“There remains a lingering perception that Peloton is a luxury item,” the company said. “We intend to amplify the platform’s value proposition via increased marketing ahead of and during our key seasonal selling period.”