Feb 7, 2022

Peloton soars after reports of takeover interest

, Bloomberg News

Peloton soars after reports of takeover interest

Peloton Interactive Inc. soared 31 per cent on Monday after reports that it’s exploring takeover options, a move that could test investors who are holding short positions.

The New York-based fitness and lifestlye company is working with an adviser after an earlier plunge in Peloton’s shares made it a takeover target, according to people familiar with the matter, who asked not to be identified because discussions are private. The takeover interest is exploratory and may not lead to a transaction, they said.

The stock rose to as high as US$32.22 as trading got underway in New York. A 12 per cent short position on its free float could mean short sellers would scramble to cover their positions, fueling shares even higher.

“You don’t want to be short over a weekend when ‘Merger Monday’ is the day of the week when deals are announced,” said Jim Dixon, senior equity sales trader at Mirabaud Securities. “The rally in Peloton from M&A chatter was fueled a tad more from the outstanding short positions on the indoor exercise bike maker.”

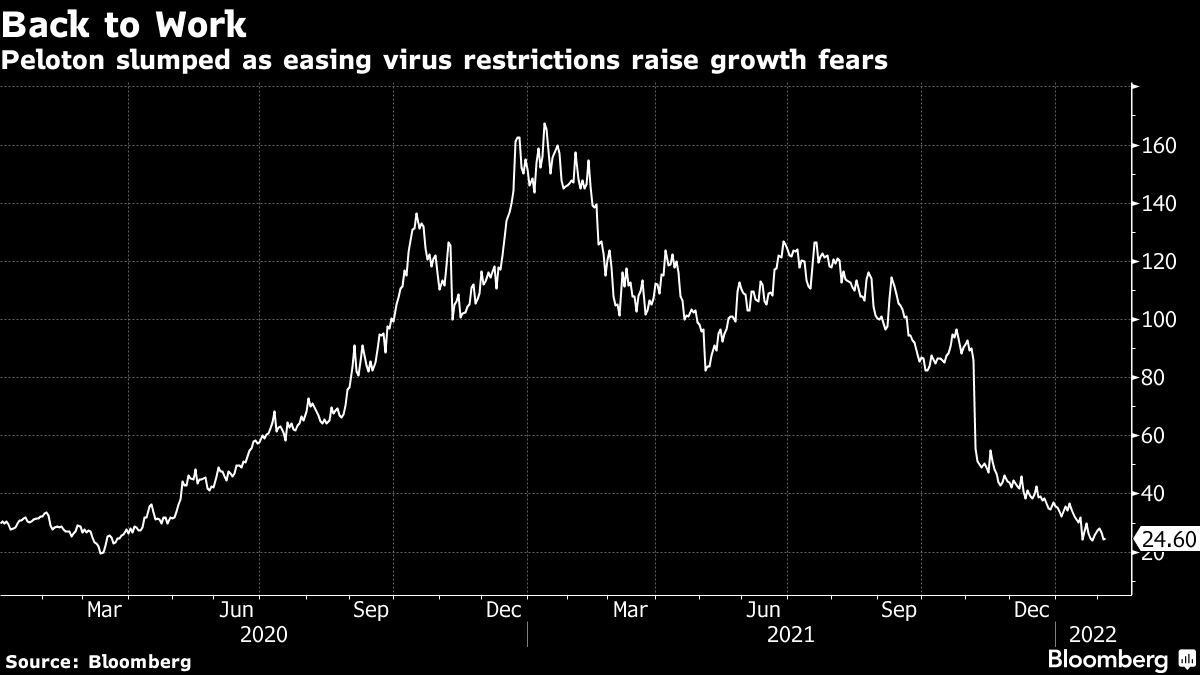

Peloton’s stock had fallen more than 80 per cent from the high a year ago as the gradual easing of pandemic restrictions fueled concern that growth would slow. Peloton’s valuation, deemed to be too expensive until early 2021, has come down sharply in the recent rout. The company’s shares now trade at 1.7 times forward sales compared to 10.5 times in January 2021. They are also much cheaper than the Nasdaq 100 Index’s 4.5 times.

At of the end of last week Peloton was valued at just over US$8 billion, based on Friday’s official market close of US$24.60 a share. That’s below its September 2019 initial public offering price of US$29 a share.

Activist investor Blackwells Capital LLC last month issued a letter demanding the company fire co-founder and Chief Executive Officer John Foley and pursue a sale. Blackwells said in the letter that potential buyers could include Apple Inc., Walt Disney Co., and Nike.

Amazon.com Inc. has been speaking to advisers about a potential deal, the Wall Street Journal reported on Friday. Nike Inc. is also considering a separate bid for Peloton, the Financial Times said. Neither Nike nor Amazon have held direct talks with Peloton, the FT reported.

Analyst views on the likelihood of a deal are mixed. John Blackledge at Cowan said any deal is unlikely given the company’s potential and vision, and Amazon isn’t an ideal fit as its focus is on mass-market selling while Peloton has a premium positioning. Wedbush’s Dan Ives said a bid from Apple would make strategic sense given the tech giant’s focus on health initiatives.