Jul 10, 2017

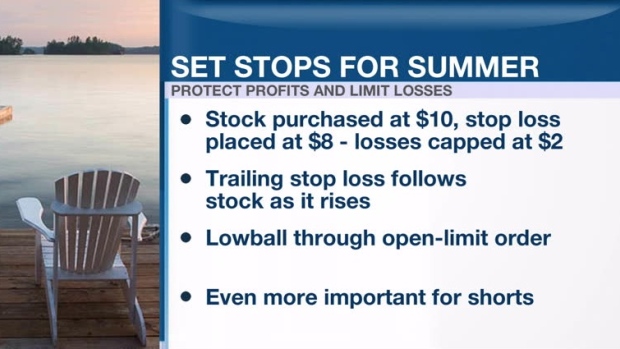

Personal Investor: Protect your portfolio with stops this summer

By Dale Jackson

With the lazy days of summer upon us we can be forgiven for not paying much attention to our investment portfolios. Yet, with just about everyone on vacation volume is low – and that means volatility can be high.

One way to buckle in your investments is through pre-set orders. Most brokerages offer them as part of their trading costs and even give tutorials on how they work.

The most common is the stop-loss. A stop-loss can be used to protect a potential profit when a stock has run up, or it can limit a possible loss. For example, if a stock purchased at $10 has a stop-loss placed at $8, losses will be capped at $2 per share.

Stop-loss strategies vary and are just one of an arsenal of conditional orders that give do-it-yourself investors the ability to pre-program their entry and exit strategies.

The real skill on conditional orders is where to set them. If you place them too close to the trading price they could be triggered by volatility unrelated to the specific security. In addition to losing a potentially lucrative position, investors could rack up unwanted trading fees.

Exactly where to place an order in relation to the trading price is up to the individual investor. You can choose whatever feels right, using target prices and trading ranges from fundamental analysis, or pick support and resistance levels from technical charts.

As a rule of thumb traders generally set orders within 10 per cent in either direction of the current price.

Investors can also go a step beyond risk management and employ opportunistic strategies with buy and sell orders.

One strategy for bargain hunters who love a stock but refuse to pay a high price: Investors can "lowball" the market through an open-limit order.

It's important to note that, in most cases, orders expire after 30 days. And, if you don't keep track, your investments may not be protected. Also, conditional orders are not always precise. If a stock is in freefall the order will trigger, but there's no certainty where it will hit. That's why it's important to place orders only on stocks with plenty of trading volume.

The trailing-stop is one popular conditional order that utilizes the latest trading technology. As a stock rises the trigger to sell automatically moves up in proportion to the real-time price - like a moving stop-loss. In addition to locking in gains, a trailing stop locks in bigger gains as the stock rises.

It's important for retail investors to be aware that conditional orders are even more vital for short positions, where there's no limit to how much a stock can rise. In such a case, a buy-stop order can limit losses or lock in profit.

Another conditional order with as many variations as an investor can dream up is a stop-and-reverse. Most often when a long position reaches a specified stop-loss it is sold and a short position is opened at the same price.

A bracket order is a stop-loss placed below the current price and a sell order above the same price.

Strategies can also be implemented involving partial positions. If a stock doubles, a stop-loss on half the position can preserve the initial investment.