Sep 22, 2017

Personal Investor: RDSP can help turn disabilities into abilities

By Dale Jackson

The Invictus games get under way in Toronto this weekend – a chance for soldiers wounded on the battlefield to show their grit and determination on the playing field.

For some Canadians with disabilities, grit and determination are not enough. That’s where the registered disability savings plan can help finance their goals.

An RDSP is a federal savings plan that is intended to help parents and others save for the long-term financial security of a person who is eligible for the disability tax credit (DTC). It’s like a registered education savings plan (RESP), where contributions are matched by government grants.

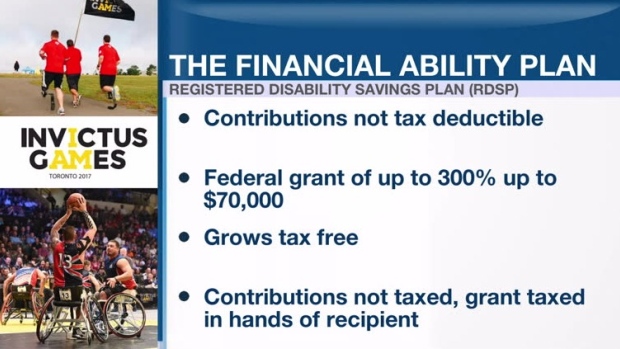

Here are a few RDSP highlights:

- Contributions are not tax deductible like a registered retirement savings plan (RRSP), and can be made until the end of the year in which the beneficiary turns 59.

- The federal government will match contributions up to 300 per cent depending on family income, up to $3,500 a year or $70,000 over a lifetime until the beneficiary turns 49.

- Contributions and grants can grow tax free. Funds can be invested, but it’s important to know the time horizon could be longer than an RESP and shorter than an RRSP. It’s best to speak with a qualified advisor who can consider the beneficiary’s individual circumstances.

- The contributions that are withdrawn are not included as income to the beneficiary, but the grant money will eventually be taxed to the beneficiary.

A RDSP can be opened up through most major financial institutions, who can help determine how much of a grant is available.