Aug 18, 2017

Personal Investor: Savers need to beware of yield traps

By Dale Jackson

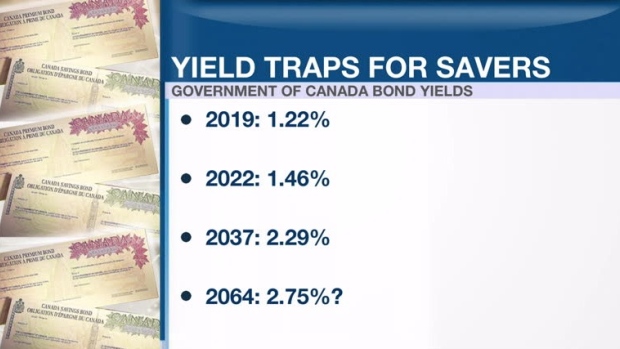

From the folks that brought you Canada Savings Bonds with yields below inflation: The government of Canada is considering issuing an ultra-long bond. The bond would pay a tempting 2.75 per cent every year for nearly 50 years until 2064.

It’s tempting because the yield is 1.53 per cent higher than the Canada one-year bond, which yields a paltry 1.22 per cent.

The ultra-long Canada bond is targeted at big institutional investors but it does flag a warning for under-appreciated savers who might be swayed toward the long end of the yield curve. Overall rates are already rising with governments and corporations hoping to secure cheap money for as long as possible.

As rates rise, those low rate bonds will lose value to bonds with higher yields.

Fixed income strategists like Joey Mack at GMP Securities suggest keeping maturities short and laddering them over periods of between one and five years. Think of the rungs on a ladder as maturity dates; the more rungs, the more opportunities there are to invest at the best going rate. Even a portfolio of laddered guaranteed investment certificates (GICs) could yield two per cent right now. It might not seem like a lot but it’s important to remember that the fixed income portion of an overall investment portfolio is intended to balance risk from the equity side of the portfolio.

On the flip side, if you’re looking to borrow, the long end of the curve is the place to be. Vehicle manufacturers, for example, are still offering rates for less than one per cent over five years. If you stretch that loan out and invest the savings in just about anything else, you will likely beat the bank.